A Primer on US Healthcare

Value Chain, History, Incentives (why is everything so expensive?), and AI's Case for Market Expansion

I’ve written about twenty industries on Generative Value. The largest, and most complex one, that I haven’t yet touched is healthcare. I’ve spent the last few months changing that. Talking to clinicians, administrators, and investors.

I’ve come away believing the opportunity for AI’s impact on healthcare is one of the most exciting applications in the world. It’s a rare opportunity for a (very) important problem to meet a new technology perfectly suited to solve it. But to lay out that case, we have to first understand the problem.

The US Healthcare System has become a $5T web of suppliers, providers, payers, and middlemen accounting for nearly 20% of US GDP:

This has created an administrative burden that costs $1 trillion annually. Hospitals have teams of people filling out forms and documentation, in addition to the clinicians themselves. I’d include some more stats, but just Google physician burnout and you’ll get the picture.

My goal of this article is to explain (as best I can) the structure of the US healthcare industry today, the incentives that made it that way, and how technology can be a part of the solution.

In summary:

There’s no one problem that’s created this system; many variables have contributed to it.

While reform is important, it’s much harder than automating processes within today’s system.

That system connects the US gov’t, insurance companies, pharmaceutical companies, healthcare providers, a few extra middlemen, and patients; all requiring documentation between each.

That administrative burden, while well-intentioned, decreases the well-being of both providers and patients.

AI provides a perfect solution to this burden.

To explain the final point, we first have to understand the system today, how we got here, and the incentives for each party involved.

Thank you to the thirty or so people I talked to in preparation for this article. If it takes that many people to understand something, it’s a real indictment of either the complexity of the system or the intellect of the one trying to understand it. I’m afraid, in my case, it may be both.

1. An Overview of the US Healthcare System

I had a friend recently tell me, ‘You love those charts with boxes and arrows…I hate them.’ Well, buckle up!

There are eight primary players in the US healthcare system:

Suppliers like (1) pharma companies and (2) medical device manufacturers who sell to providers either directly or via (3) distributors

Providers like (4) pharmacies, (5) hospitals, clinics, dental offices, etc, who have (6) group purchasing organizations (GPOs) to purchase on their behalf

Payers like (7) insurance companies and the (8) US Gov’t

We can visualize those parties involved here:

The Suppliers

Pharma companies and medical device manufacturers are the two most profitable segments of the value chain.

The vast majority of the most valuable US healthcare companies fall into these categories:

Pharma companies essentially act as the venture capitalists of the healthcare industry: developing drug pipelines in the hope that they find a breakthrough compound that can become a blockbuster drug.

About 10% of drugs make it to market from the clinical trial pipeline, and 1% provide half the profits to pharma companies (from the Acquired episode on Novo Nordisk).

So, pharma companies get a lot of criticism for being profitable, and they do have strong gross margins (70-80% for the large pharma companies). However, much of that is funneled back into R&D to fund further drug development.

Drugs have 20-year patents from filing, but since patents are filed early in development, most drugs have only 7-12 years of protection remaining when they reach the market. After which, drugs become much less profitable due to generic competition. As they say in VC, you’re only as good as your last deal (drug)!

They then sell through distributors or directly to hospital organizations. For context, 92% of prescription drugs are sold through distributors. It’s a lower percentage for medical devices, as they often need to provide service directly to hospitals.

The three largest distributors are McKesson, Cardinal Health, and Cencora, who run very low-margin businesses but have 90+% market share:

Providers

Providers include pharmacies, hospital organizations, clinics, and any other healthcare provider directly serving patients. The CMS publishes annual data on National Health Expenditures, and breaks down spending by category:

Payers

Finally, payers are the insurance providers. The US Gov’t (Medicare + Medicaid) makes up $1.9T of that spending and private insurers make up $1.5T.

According to a 2022 report from the US Census, 54% of the insurance-covered population is on employer-sponsored insurance, 36% on gov’t-sponsored plans, and the remaining 10% covered through marketplace coverage. About 92% of the population has insurance.

Now, if this were the whole system, it would be relatively straightforward. Suppliers make products, providers deliver care, and payers cover costs.

But if there’s one thing Charlie taught us, incentives rule the world. And incentives created middlemen, and middlemen created complexity.

2. An Abridged History of How We Got Here

Three big historical forces created today's system:

First, employers and the government became the primary payers. This started in WWII when wage controls led employers to offer health insurance as benefits, then became permanent with tax exemptions. Medicare and Medicaid in 1965 made the government a major healthcare payer, eventually becoming the largest.

Second, as the industry grew more complex, middlemen emerged to facilitate transactions. PBMs formed to manage pharmacy benefits and negotiate drug prices on behalf of insurers. GPOs formed to give hospitals collective bargaining power with suppliers. This made sense initially when the industry was fragmented; however, as both sides consolidated, these middlemen retained their power despite being less necessary.

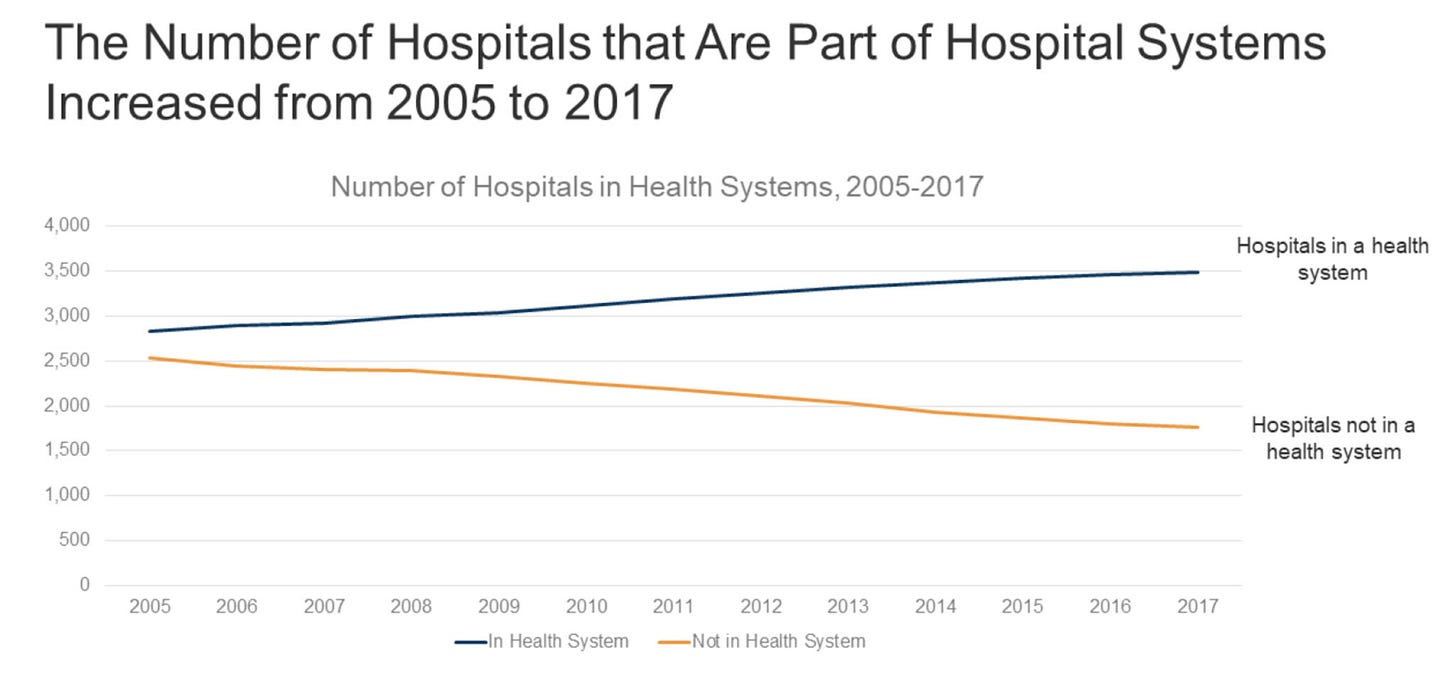

Third, over the following decades, the industry consolidated. Pharma companies merged because drug development became increasingly expensive and risky. The "VC model" of drug discovery required firms with enough capital to withstand multiple failures while hunting for blockbuster hits. Insurance companies consolidated for increased bargaining power and the benefits of vertical integration. Now, providers are consolidating too, as hospitals merge into massive health systems to become more efficient and increase negotiating power.

This created a system of oligopolies, where every transaction requires multiple intermediaries, each taking their cut and requiring documentation to pay for their services.

3. Insurance & Healthcare Incentives: Why is Everything so Expensive?

Insurance seems simple enough: you get a service, the provider submits a claim, insurance approves or denies it, then the provider appeals or not, and you get a bill. On the back end though, everyone wants to ensure they get their piece of the pie.

Abridge's founder said it well: "We're not compensated as doctors for the care that we deliver; we're compensated for the care that we documented that we deliver."

Once that documentation is complete, it's translated to medical codes, which are then sent to the insurance provider.

Meanwhile, insurers scrutinize claims closely, and frequently deny them due to poor documentation. This creates an adversarial relationship where providers must extensively document everything to defend against denials.

PBMs & How Drugs are Priced:

Perhaps the most contentious and complex piece of the value chain are pharmacy benefit managers (PBMs). They negotiate rebates for the insurance companies in exchange for the insurance companies putting their drugs on a formulary (list of drugs covered by insurance).

Because the pharma companies know they'll have to pay a cut of their fees back, they raise prices. On average, about 30% of gross drug costs come from those discounts. However, they aren’t paid out as discounts, they’re paid out as rebates.

So pharma sets high list prices (known as the wholesale acquisition cost (WAC)) -> PBMs negotiate rebates -> insurance pays high list prices -> pharma pays rebates back to insurers -> PBMs take a cut of those rebates.

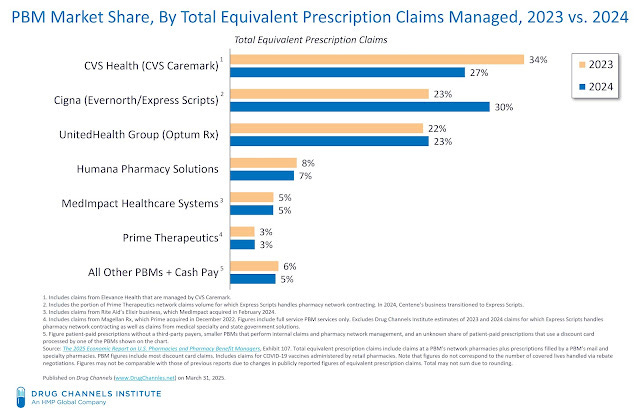

The fact that brings up the most contention is that two of the three largest PBMs are owned by the insurers they’re representing (Cigna/ExpressScripts and UNH/OptumRx) and the third is owned by a pharmacy submitting claims to that PBM (CVS/Caremark - CVS also owns a health insurance company):

This vertical integration means PBMs are parts of the very same organizations they’re representing, and still taking a cut of prices. See operating margin of UNH and Optum:

Hospital & Procedure Pricing

This same pricing process plays out with medical procedures, forcing list prices higher. Every procedure in a hospital has an agreed-upon price with insurers. Providers will set artificially high list or “chargemaster” prices because they know it will be negotiated down by insurers.

This creates two problems:

It locks everybody into the insurance ecosystem. Because if patients don't have insurance, then they don't get all of those discounts, making services very expensive.

All this negotiation creates more administrative overhead to manage. The exact billing process varies by patient and their insurance, which can include a combination of deductibles, copays, and coinsurance across multiple plans. Thereby creating even more administrative overhead for both providers and payers.

The Administrative Costs of All This Bureaucracy

Now, all of this complexity and bureaucracy creates this massive administrative burden I’ve been alluding to. And what a burden it is!

Admin costs make up ~20-25% of the $5T US healthcare industry.

Insurance administration costs are ~7% of all US healthcare costs.

Physicians spend roughly between 25% and 50% of their time on admin work (studies vary widely).

This clinical admin work starts with documentation. Every clinician has to document interactions with patients to ensure they can be billed for those services. Some services require prior authorization, which forces the provider to call/fax/submit a PA to the payer to get approval before providing a drug/procedure. Drug pricing programs like 340B help keep expensive drugs affordable, but require a another process of documentation and compliance.

“So much of the story on the clinician side is about agency... You're always paying debt on work, you're never able to get ahead, and you don't have any control over your time. That's why they call this 'pajama time'—this affliction where doctors are writing notes after dinner or after their kids are in bed.” - Shiv Rao, founder of Abridge

This is where AI comes in. For the first time, we have a technology perfectly suited to handle these text and voice-based administrative processes.

4. Healthcare Software, AI, and the Case for Market Expansion

If you made it this far, (1) I apologize for the headache, and (2) time for some optimism!

The last two decades were about digitizing healthcare, getting everything electronically stored. Now, the industry's mostly digitized. However, that digitization came at the expense of providers.

Clinicians had to document patient interactions in free-form notes, then admin teams had to restructure that information for billing and claims. Any mistakes led to disputes with the insurance company.

Because of this complexity, healthcare software's efficacy was limited, and it placed a huge burden on providers. This meant value primarily accrued to EHRs (documentation) and revenue cycle management (billing).

With LLMs, we now have the best way to process unstructured information in the history of technology.

The starting point is AI scribes, which immediately reduce the admin burden on clinicians. Instead of clinicians spending appointments or evenings taking notes, they can spend them with patients.

Abridge, the $5B AI scribing company, has been at the lead of recent scribing startups (after their competitor, Nuance, got acquired by Microsoft for $20B).

Their CEO laid out the path to expanding past scribes (lightly edited for clarity)

"If you believe as we do that healthcare is about conversations—that it's one of the first original signals in healthcare—then you start to see that any number of different workflows are beyond it. It's not just clinical notes, it's also orders... After orders is a claim, is a code, is a bill that goes to the insurance company—so all things revenue cycle."

This initial automation creates a flywheel of:

Automate admin work

Improve documentation and increase the value of EHRs/RCMs

Automate more admin work (while models get better)

Given over $1T is spent annually on healthcare admin, that becomes one heck of a flywheel. I think it lays out the case for pretty massive market expansion across the healthcare software/AI landscape.

Flare Capital Partners made an excellent map of the various companies across this landscape:

Now, as basically every healthcare professional will tell you, it’s not perfect: models are still improving, regulations make adoption slower in healthcare, mistakes can be high consequence, and data privacy is a real concern. So, adoption cycles are long, and it may take longer than expected to provide the scale of impact that’s possible.

But like I said at the beginning, this is a rare opportunity where a massive problem meets a new technology perfectly suited to solve it.

That’s something to get excited about.

If you’re working on this problem or with these tools and have thoughts on the future, feel free to reach out. As always, thanks for reading!

Disclaimer #1: While my goal is to simplify, this is not a simple issue. I’m focusing on one problem: the administrative burden, how it came to be, and how it could potentially be fixed. There are many others, and this impacts real lives. I could make many more disclaimers but I’ll leave it at that.

Disclaimer #2: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Very detailed and well written! We've been working with PBMs as a startup and are already see too much manual intervention everywhere. I reckon that a lot of these processes will be automated in the next 2-3 years and operational / admin overheads will be reduced substantially.

Brilliant Deep Dive 🌟 Thanks for sharing this with me - crazy scale of the opportunity because it's so backwards. 100s of Billion Dollar Companies to get built 🤯