Physical Design Software: The Strongest Moats in Software

An Overview of the History, Market, and Trends in CAD, Simulation, and EDA software

When we look back at the history of software, we see that nearly every category has seen waves of new companies that rode technology shifts to unseat incumbents. The cloud laid the path for much of this disruption. It fundamentally lowered the barrier of entry to software development. Companies could now build software with a credit card instead of a data center. Nearly every industry in software saw “cloud-native” businesses rise up and compete with incumbents.

One industry stands out as an exception: physical design software.

The CAD (computer-automated design), EDA (electronic design automation), and simulation providers are more dominant now than ever before. Autodesk, Cadence, Synopsys, Dassault, Ansys and others are $30B+ software companies that have consolidated their industries over a 40+ year period. They epitomize the “vertical software” value prop: industry-standard software with high profit margins, high switching costs, and high barriers to entry.

Add in the technical complexity of these tools, and we get the strongest moats in enterprise software.

This article will be a deep dive into this space structured as follows:

The History of Physical Design Software

Why Haven’t the Leaders been Disrupted?

An Overview of the Physical Design Technology

An Overview of Markets

What Could the Future of This Market Look Like?

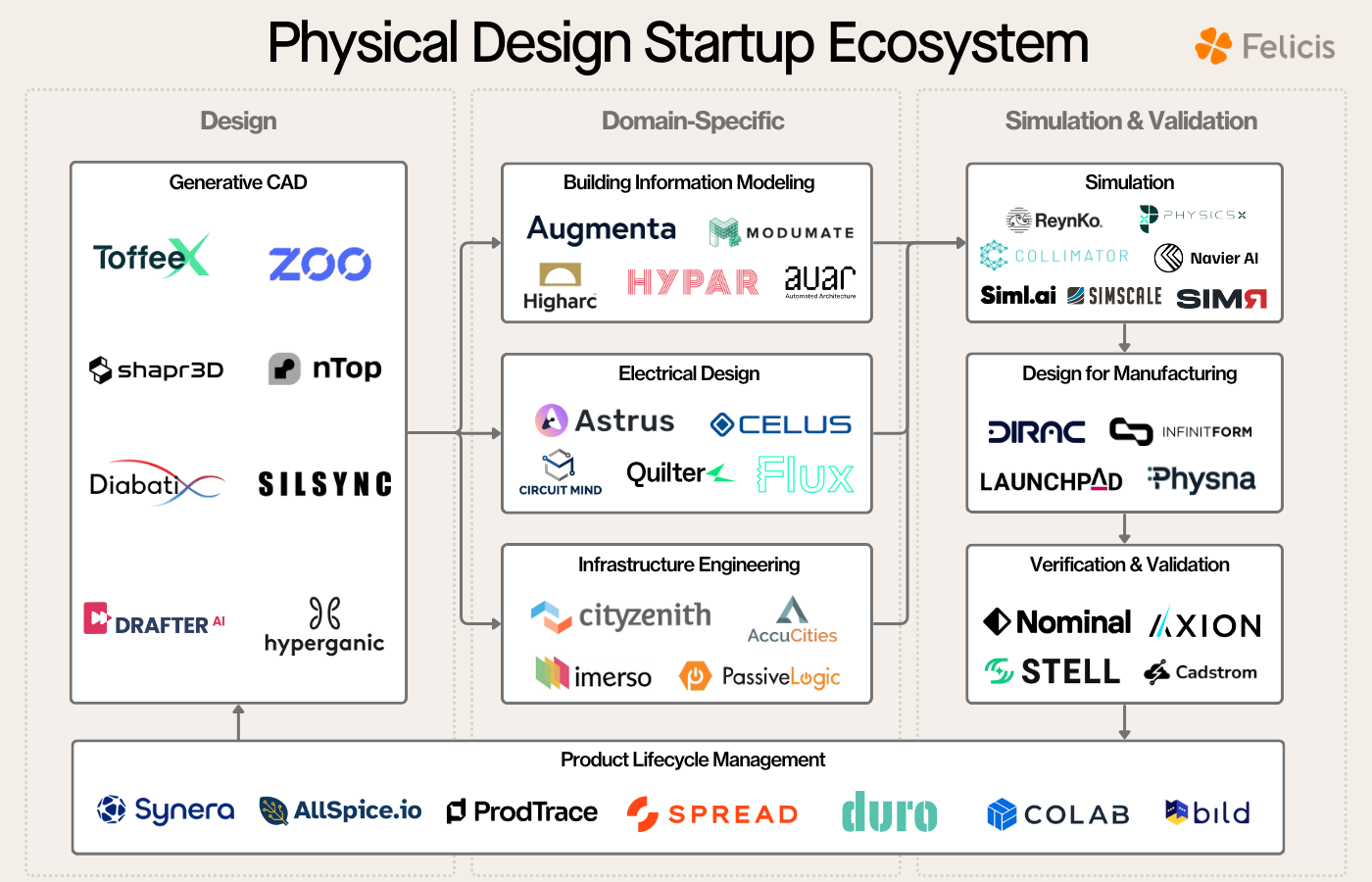

Before diving in, here’s the current landscape of the physical design process, more details later:

Physical design software is the tooling used to design any physical product from semiconductors, to rockets, to toothbrushes.

Note: this is a broad generalization of the industry. I’ll write future industry primers on the EDA industry at least, as it’s underrepresented in this article. Public companies that specifically interest me are Autodesk, Synopsys, and Cadence so I see future individual analyses coming on those topics.

1. A History of Physical Design Software

The history of physical design software can broadly be broken down into two parts: the early history of the industry and the rise of the “modern” design companies.

Much of this section came from, ”The Engineering Design Revolution - A History of CAD”, a book on the history of CAD which shapr3D has on their website.

The Early History of Design Software

Prior to the 1960s, physical systems were designed and drafted by hand:

Like many technical trends, the CAD industry began within large companies of the time. In 1957, Patrick Hanratty (often referred to as the father of CAD) created Design Automated by Computer (DAC) in GM’s Research Labs. By the mid-1960s, the large manufacturing companies had begun to realize the value of computer-based designing. Most notably, automotive companies like Renault and Ford focused on mathematically modeling complex surfaces. The Renault systems would go on to become Dassault Systemes, one of the four major general CAD companies today.

Soon after though, the industry would see the first commercial systems from 5 primary companies: Applicon, ComputerVision, Auto-trol, Calma, and M&S Computing (Integraph). These companies were mostly hardware manufacturers who developed software to help sell their hardware. Each machine sold for about $150,000 in 1972. Ansys would be founded around this time as well for simulating engineering scenarios.

This 5-company oligopoly would strengthen until the rise of the workstation and the PC.

The Rise of “Modern” Design Software

The decade of the 1980s would shake up the existing oligopoly and cement the industry’s structure for the next (*checks calendar*) 40 years.

At the beginning of the decade, each machine cost ~$300k and was operated by CAD engineers. The rise of the engineering workstation (from companies like Apollo) led to the separation of hardware and software. Shortly after, the PC would be released as well, although it took time for the performance of PC semiconductors to support CAD software. This opened the door for early software companies to only develop software, and not worry about hardware development.

From 1981 to 1986, six of today’s oligopolistic design companies were founded: Mentor Graphics (1981), Autodesk (1982), Cadence (1983), Bentley Systems (1984), PTC (1985), and Synopsys (1986). These companies made design software specifically for workstations and/or PCs, creating a cheaper and more flexible alternative to the incumbents.

The PC CAD vendors also made a savvy move (one that Clay Christensen would be proud of), their idea was this:

Sell 80% of the CAD functionality for 20% of the cost. Sell only software. Outsource sales to “channel partners” who sold hardware and provided training services.

This provided a fundamentally disruptive business profile that the incumbents couldn’t keep up with.

From the mid-1990s to today, the industry would consolidate through acquisitions and product expansion. The general CAD providers now have a four company oligopoly with Autodesk, Dassault, PTC, and Siemens (who’s CAD/PLM division would be formed through acquisitions in the 2000s). EDA providers have consolidated to Synopsys, Cadence, and Siemens EDA. With Synopsys’ acquisition of Ansys, the industry will further consolidate.

If this ending of history feels rather abrupt, that’s because it is. The industry hasn’t seen major changes since the 1980s. Companies have switched pricing models and have started to migrate to cloud-based versions of products, but the industry structure has remained mostly constant.

This leaves us in the position today of an industry made up of oligopolies, asking ourselves, “Is it possible for this to change, and what would need to happen to drive that change?”

2. Why haven’t these companies been disrupted?

It’s important to take a step back and answer the most important question driving this industry. The answer is essentially a case study on what software moats can look like. I see three driving forces here:

Technical Complexity: This is some of the most complex software in the world. EDA software, for example, has millions of lines of code for each tool. It’s hard to build these tools THAT ARE JUST AS GOOD, it’s even harder to build tools that are better. This builds out an expansive barrier to entry, especially for software.

Switching Costs and Risks: Do companies want to risk moving their IP and retraining employees? The complexity of the software means moving tools requires significant retraining time, meaning less productivity time, and potentially downtime. Plus, if design flaws result from switching software, the costs are much higher than software defects.

The GTM Problem: All the big companies use these tools, and don’t want to retrain their employees. Mid-market and SMBs are standardized on Autodesk which is taught in schools everywhere. These are essentially industry standards. There aren’t many consumer use cases, so the bottom of the market doesn’t provide much value. This means there’s no good place for a company to start selling.

All of this leads to the “inertia” of software businesses, meaning an alternate product has to be magnitudes better for a company to switch software products. We’ve never seen a large enough performance gain to justify companies switching this software at large scale.

3. An Overview of the Physical Design Process

The evolution of the physical design software industry has been characterized by the consolidation around a few dominant players. Over the past four decades, companies like Autodesk, Cadence, and Synopsys have not only expanded their technological capabilities but also absorbed competitors through strategic acquisitions, reinforcing their market positions.

This is the best image breaking down the physical design process I’ve found:

Requirements Gathering & Conceptual Design

The first step in design is requirements gathering from internal stakeholders, suppliers, customers, and customers. A project manager will coordinate interactions with all these people and ensure that a design/component is being developed according to specifications.

Then, a designer will create a conceptual design, get feedback from stakeholders, revise, and pass on to the engineering team. They’ll typically use surface modeling tools like Autodesk Alias or Rhino3D for this step.

Detailed Design

An engineering team will then refer back to requirements and start to design the actual component/system. The steps will go from system design (I need an engine of X size), to subsystem design (I need x amount of cylinders), to component design (the parts that make up cylinders). For mechanical systems, generic CAD tools will typically be used.

Many industries, however, need domain specific design tools. Some examples include EDA tools for chip design, PCB tools for circuit boards, BIM tools for building construction, specific tools for roads/bridges/tunnels/water, and manufacturing plant design.

Simulation

After the system has been designed in detail, the system needs to be simulated as close to real-world scenarios as possible. This includes techniques like finite element analysis for load testing and computational fluid dynamics for liquid/gas flows. Any failures need to be redesigned, and retested. Ansys is the leading provider in this space.

Design for Manufacturing & Verification & Validation

Essentially, 3D CAD tools can create any shape in existence. But, we can’t manufacture any shape in existence. DFM is the process of analyzing what each manufacturing step is capable of: what materials are available, are they high volume, does it have to be metal, can the shape be simplified, how will it be manufactured - injection molding, casting?

Verification & validation are the final steps of testing, and this is especially important in chip design. The actual performance of the chip/product needs to be tested as thoroughly as possible as any manufacturing flaws will result in millions of dollars of waste. Any flaws need a root cause analysis, a fix, and a retest.

This is the most manual step of the design process right now. An experienced designer is typically required for large projects in this stage.

Project Lifecycle Management

Throughout this entire process, PLM tools manage the data and components on the back end. The first part of this is managing parts in a tree-like fashion, tracking which components are in each systems, and changes to any of the process. The second piece is project data management, managing data such as CAD files, bills of materials, and version controls.

4. An Overview of the Physical Design Software Market

I think about the segments of this market into: the 4 general CAD providers, domain-specific providers, and challengers.

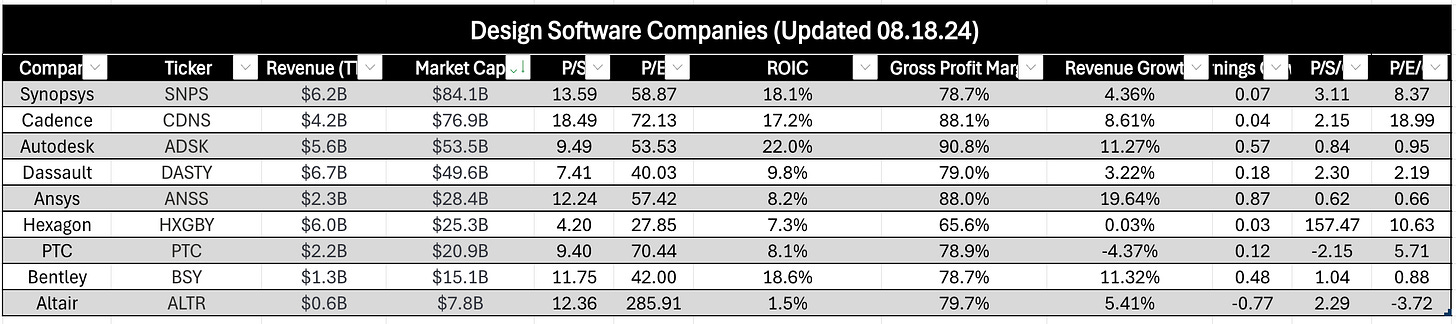

We can view comps for the public companies in this space here:

A few points: strong profit margins, fairly strong ROICs, not great growth, and VERY high multiples relative to growth.

The CAD Oligopoly: Autodesk, Dassault, Siemens, and PTC

These four companies offer a similar breadth of products with different focuses on verticals and market segments. They all offer CAD, PLM, and a host of other design software.

Autodesk started with AutoCAD, focused on individual users and not so much enterprises, and they’ve maintained that position. They dominate the mid-market and SMBs for CAD software (AutoCAD, Inventor). The largest piece of their business is in the construction industry with BIM software (Revit, AutoCAD Civil), but they offer an incredible breadth of products: PCB design, construction project management software, water system design, construction payroll, bid management, and so they’re expanding both in construction software and in design software.

Dassault is the oldest of the four players and the slowest growing. Their initial niche was for automotive and aerospace companies, and they are still the market leader in those spaces. Their enterprise offering is CATIA and their mid-market offering is Solidworks, both standards in the industry.

Siemens is a massive industrial company, and they’ve continued to grow their industrial software business. Their integration with PLCs (computers for manufacturing lines) provides them both a hardware/software integration advantage and a distribution network advantage. Their Siemens NX software is enterprise CAD, while Solid Edge is a mid-market product. Siemens has the largest PLM business of the four, and it’s common to have Siemens PLM with CAD from another provider.

Finally, PTC is the smallest of the four. They focus on the manufacturing segment, and made a push in the 2010s to integrate AR/VR and factory analytics into their platform. Those efforts haven’t been too successful, and likely are a product of making acquisitions too early before the technology was ready.

We can see their market segmentation here:

Domain-Specific CAD Software:

The best example of this is EDA software for chip design, with Synopsys and Cadence, two of the highest valued software companies in the world. I would be better served writing a follow up article breaking down the EDA space. For a primer, here’s a breakdown of EDA product segments and market leaders in each segment:

Another example is infrastructure engineering tools for roads, bridges, tunnels, and plants. Bentley Systems is the market leader in this space with OpenRoad, OpenBridge, OpenRail for designing their respective projects. They are essentially a standard in this space (I heard from one reference that 48/50 US states use Bentley products). In plant design, Hexagon, Schneider Electric, and Bentley offer solutions for these products.

Challengers

No startup has broken into the upper echelon of CAD companies (yet), and relatively few have been acquired at $1B+ valuations.

One of the most successful startups came from the founder of SolidWorks, who founded OnShape in 2012, and sold to PTC in 2019 for $470M. Startups are attempting to take on each vertical in this space, but none have reached unicorn status.

The moats of the incumbents are so deep, and the switching costs are so high that this market has been mostly impenetrable. With that being said, I think there are specific verticals where companies could be built, more on this next.

5. What Does the Future of Design Software Look Like?

The future of these tools can be summarized in one sentence: “Cloud-based, collaborative tooling with an increasing amount of design automation.”

Specifically, I’m excited about two trends in this space that will see innovation in the next few years.

The most exciting trend in design software is generative design, an idea with a lot of potential but little value creation YET. Autodesk has trained a foundation model on 3D data called Bernini. While this (probably) will never get to the point where you say “design me a car”, there’s no reason why simple brackets, or nails, or individual components can’t be designed using generative models. There’s a real opportunity for a highly technical team to build exciting software here and help push the industry forward.

The other area where I continually hear the need for innovation is around design for manufacturing (or constructability reviews in construction). This process essentially requires taking a design, looking at manufacturing processes and material availability, and saying, “Can we actually manufacture this?”

AI, right now, is really good at summarizing large amounts of data, taking context from requests, and using that to automate repetitive processes. It should be able to automatically assess designs, identify potential issues using data from manufacturing processes and material availability, and make optimization recommendations based on that.

Physical design is a complex space that provides a wonderful case study on what moats can look like in software.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

I learned a lot from this. I certainly had not known Siemens is good at software. I had a biased & ignorant opinion that their role is to employ a lot of people and collect state subsidies. A reminder that bias is self-defeating and opinion without data is delusional.

Thank you!

Great write up. Siemens has an extensive software products beyond PLM, CAD and EDA. I was at their software conference this year and they are developing some impressive AI capabilities as well as connecting related products. It would be interesting to have a deeper follow up on comparing the leader’s product lines.