Q3 '23 SaaS Report

Trends & Data across SaaS

Trends

When I look across the enterprise SaaS space, I see three trends playing out:

Consolidation

Cautious Enterprise Spending

Stabilizing Optimizations

Companies want to consolidate on SaaS platforms to save both time and money. IT teams are acting as a chokepoint in enterprise modernization; they simply don’t have enough resources to support all the asks they’re getting from business counterparts. Because of this, a bubble in SaaS had been brewing. The amount of enterprise SaaS tools was becoming unbearable.

In 2022, that bubble burst.

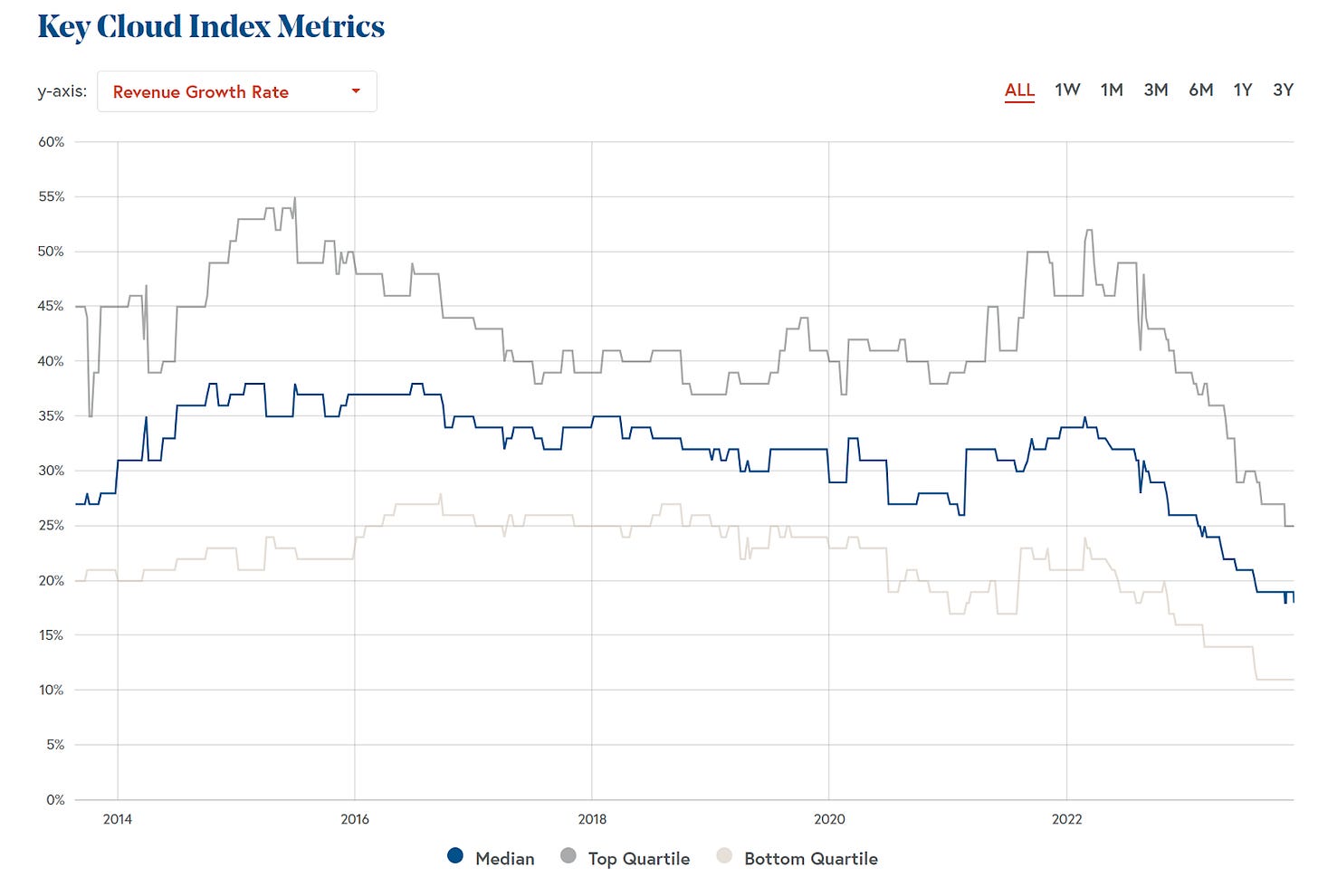

Growth rapidly declined as enterprises undertook their first real optimizations in a decade. For the last 7 quarters, we’ve been waiting to see when that optimization would stop. Over the last 2 quarters, we’ve seen that growth stabilize:

The BVP Cloud 100 charts metrics across 100 of the largest cloud companies, most of which are SaaS providers.

Consolidation

I see consolidation as the defining trend in enterprise software over the next decade. I’ve talked about how companies like ServiceNow are primed to take advantage of this trend. In general, my view is that it is a challenging time to be a small enterprise software company; especially when they only have one product. Frank Slootman, Snowflake’s CEO, describes it well:

“You know, you go back to 2015, you know, Snowflake, you know, really swam in swim lanes that were very narrowly defined and very well understood. You know, now we're in a mega-market, right? These are very very broad-based platforms that are -- that are incredibly capable in many directions. And we've been working very hard, you know, as you've seen in recent years, in delivering just an absolute ton of capabilities to enable these platforms and all these different directions.”

We see these large providers in Microsoft, Salesforce, ServiceNow, Workday encroaching on the other’s spaces leading to intense competition for IT budgets. Distribution network is really key to take advantage of this trend. A clear value proposition is vital in this environment. CrowdStrike does an outstanding job of this:

“CrowdStrike is cybersecurity's AI consolidator, liberating organizations from legacy AV, subpar EDRs, and a hodgepodge of hygiene, compliance, vulnerability, device management tools, costly and clunky SIEMs, and a confusing alphabet soup of immature cloud point products.” - George Kurtz, CEO

These sentiments on consolidation were echoed by management of Salesforce, Datadog, Workday, and ServiceNow on their earnings calls.

Cautious Enterprise Spending Environment

We continue to see a cautious enterprise spending environment. We’re seeing growth rates stabilize while optimizations are slowing, but enterprises are not fully opening up their budgets yet. When we look across earnings for some large enterprise SaaS companies, only ServiceNow is materially accelerating their earnings.

CrowdStrike’s CEO talked about the challenging spending environment, confirming notes from the cloud companies that deal cycles are elongated:

“In general, you know, buyers are still cautious…When we look at the current macro environment, it is stable. But as I talked about in the Q&A and in the prepared remarks, it's still a challenging environment. It takes a lot of effort to get deals done.”

Reiterated by Workday’s CEO:

“I don't think we see any improvement in the macro or do we see it getting any worse. It's pretty consistent with what we've seen all year long.”

Stabilizing Optimizations

In the thread of conservative spending, we’re seeing conservative optimizations as well. This alludes to the holding pattern I alluded to earlier. Quite simply, organizations are being cautious with the actions they’re taking.

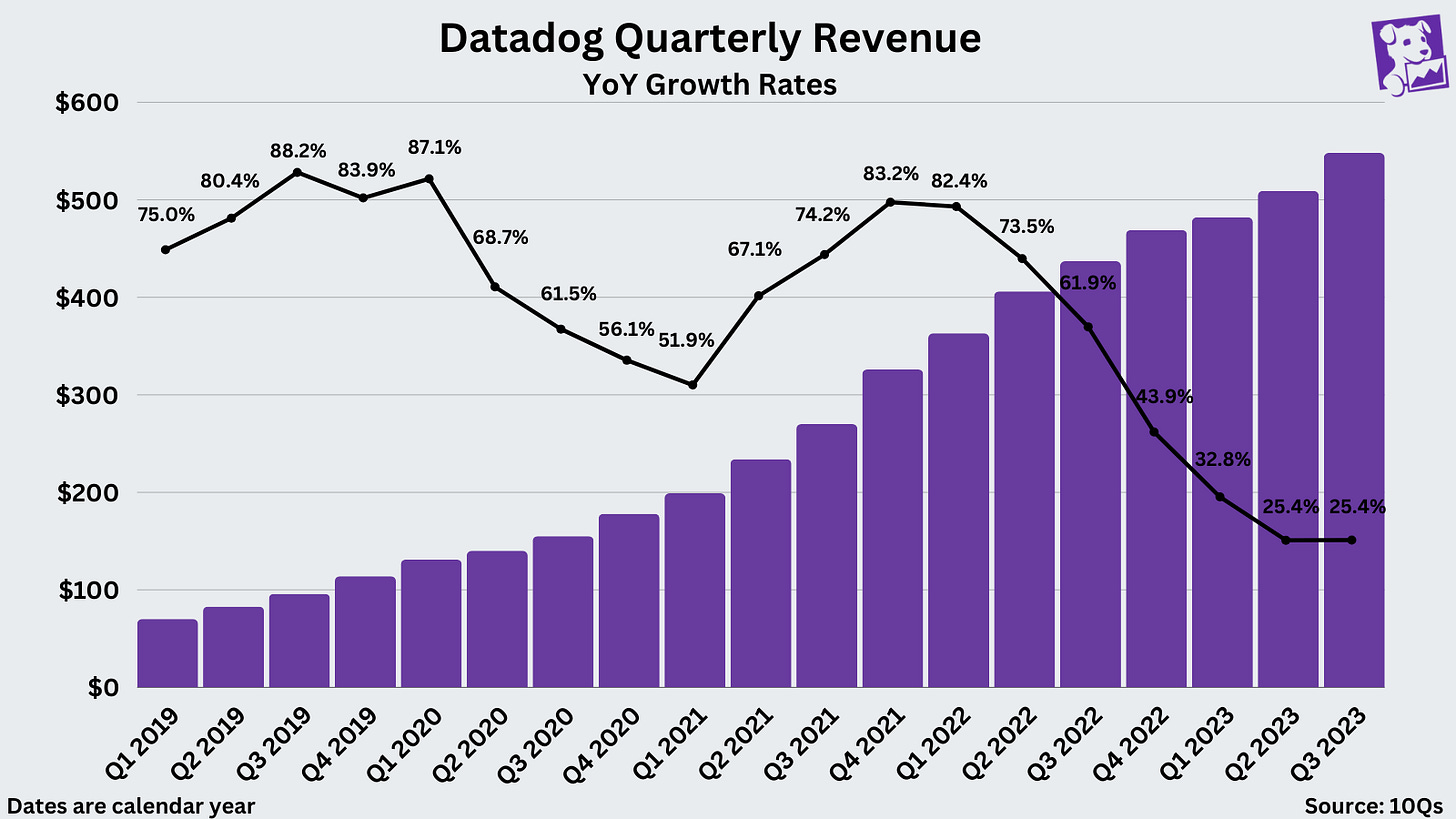

Snowflake & Datadog (both consumption-based products) provide good insight into optimizations:

“It looks like there is a -- there's a lot less overhang now in terms of what needs to be optimized or could be optimized by customers. It looks like, also, optimization is more -- is less intense and less widespread across the customer base.” - Olivier Pomel, Datadog CEO

“People have really driven themselves through these processes and rationalized themselves and are now in a good place to move forward. You can only optimize and rationalize so much at some point.” - Frank Slootman, Snowflake CEO

This brings up the point I frequently mention, the value proposition has to be so good that it forces action to buy. When analyzing these companies, it’s vital to keep asking what the value proposition is to customers AND if that value can be replaced by a competitor.

The data is pointing to us seeing continued, but slowed optimizations, over the coming quarters…while enterprises are strategically investing in areas like AI & security.

Individual Company Performance

I track growth rates & revenue across Salesforce, ServiceNow, Workday, Snowflake, CrowdStrike, Datadog, and MongoDB.

Valuations

Revenue multiples are trading at much more reasonable values compared to 2021, and much closer to their historical valuations:

I track all my valuations as multiples compared to growth. With tech’s 2023 run, growth-adjusted multiples have gotten quite expensive. Jamin from Clouded Judgement tracks historical revenue multiples compared to growth:

There is hope!

Net New ARR has started to rebound. NNARR provides a metric for acceleration of SaaS revenue. Below the chart shows that software companies are adding 3% more ARR in the most recent quarter compared to a year ago. NNARR is a decent leading indicator of ARR growth.

I like to keep this newsletter long-term focused. Over the long-term, companies with a great product, a strong distribution network, and a compelling value proposition will do well.

Disclaimers:

This is not investment advice; you should do your own research before investing.

I own shares of Microsoft stock.

I’m a Microsoft employee; all the information contained in this article is public information or my own thoughts.