Q3 '24 Hyperscaler Update: CapEx Growth Continues

Market share, revenue, and trends for Microsoft, Amazon, and Google

Three things in hyperscaler-land continue to be true:

They are growing CapEx and pointing towards more CapEx growth next year.

They are capacity-constrained on AI compute, although seemingly less severely than in past quarters.

They are investing based on the demand signals AND potential of AI applications.

This all points to a Pascal’s Wager situation I called out in my State of AI Markets article.

The equation for hyperscalers is relatively simple: data centers are at least 15-year investments. They are betting that compute demand will be higher in 15 years (not a crazy assumption).

If they do not secure chips and natural resources like land and power, three things could happen:

They will lose business to competitors who have capacity.

They’ll have to secure sub-optimal land with worse price/performance profiles.

Challengers will buy this land and power capacity and attempt to encroach on the hyperscalers.

If they secure this land and don’t need the computing power immediately, they’ll wait to build out the “kit” inside the data center until that demand is ready. They might’ve spent tens of billions of dollars a few years too early, and that’s not ideal. However, the three big cloud providers have a combined revenue run rate of $225B.

Put simply, the downside is huge! Miss out on (1) a gold rush of billions of dollars of AI infrastructure or (2) a legitimate transformational technology. On the other hand, the downside is that margin profiles will be worse for a few years. For some of the most profitable companies to ever exist, this means little to them.

That leads to CapEx charts that look like this:

Microsoft, Google, Meta, and Amazon grew CapEx on average 55% Y/Y and have spent $199B on CapEx over the last four quarters.

A caveat here is that Microsoft predicted that supply is starting to catch up to demand.

“We ran into a set of constraints, which are everything because DCs don't get built overnight. So there is DCs, there is power. So that's sort of been the short-term constraint. But I feel pretty good that going into the second half of even this fiscal year that some of that supply/demand will match up.”

So, at the very least, there are signs that CapEx spending might moderate in the near-mid-term. On to a summary of the quarter for the hyperscalers.

Market Statistics

First, if you’ve been reading my cloud updates, I’ve been saying to take market share numbers with a fistful of salt. Microsoft restated Azure this quarter, removing Enterprise Mobility and Security & Power BI from the Azure division:

This is particularly important as it drops Azure’s revenue by several billion dollars and subsequent market share by a few percentage points. The approximate new market share between the three cloud providers looks like this:

Again, these numbers should be viewed with a meaningful margin of error. Remember that AWS includes enterprise apps in their numbers, GCP includes Google Workspace, and most of Microsoft’s enterprise business could fall into the cloud category.

I find a more important variable to be “market share momentum” or the net new revenue over the last four quarters. This gives us the best idea of where market share is trending:

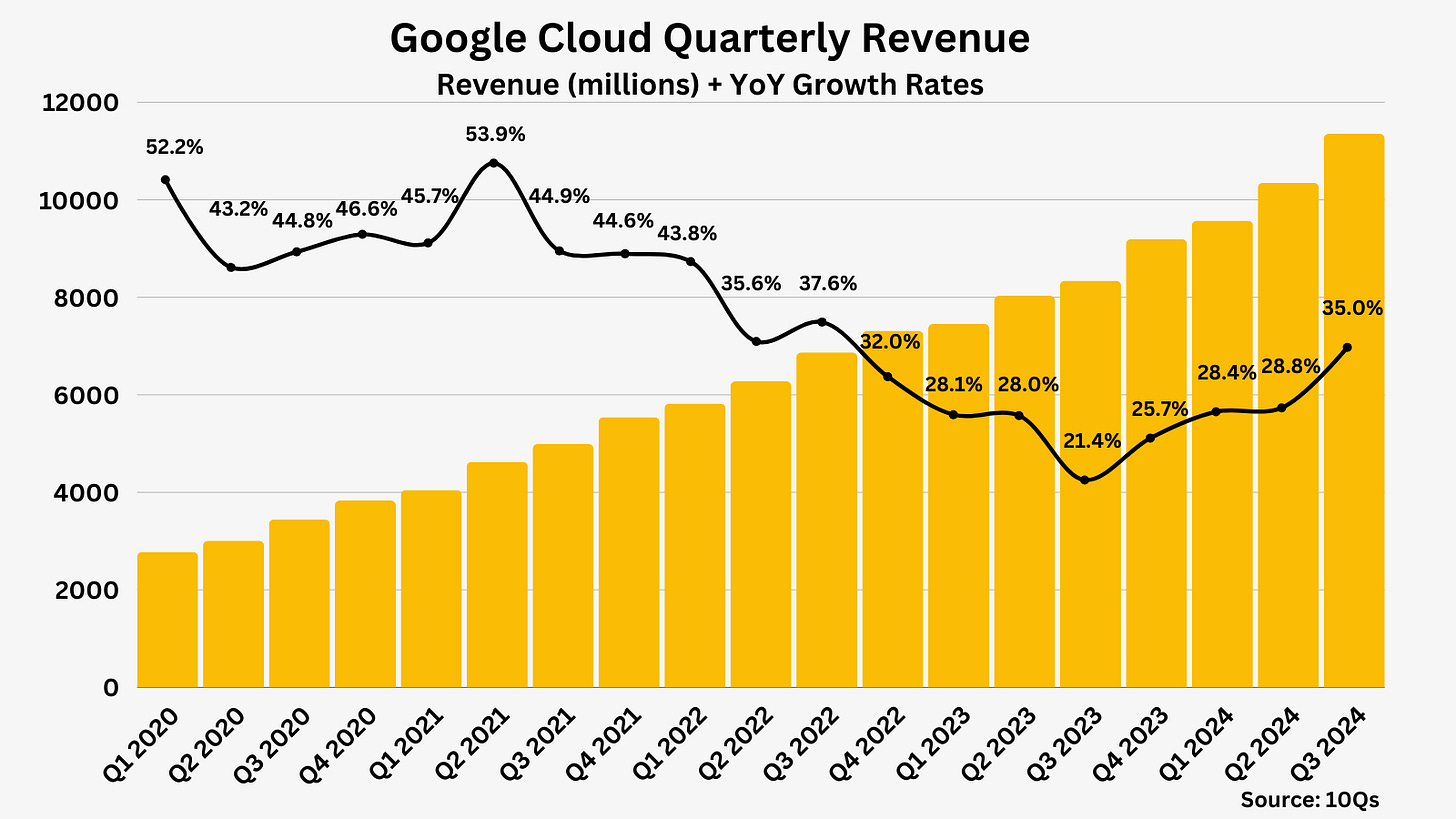

Finally, all three hyperscalers continue to grow incredibly well at their scale. A reminder: these are some of the best companies ever to exist, with $200B+ in annual run rate growing 19-35% a year.

Azure

Microsoft’s distribution network continues to shine. I want to highlight a few stats from the earnings call:

We now have over 16,000 paid Fabric customers over 70% of the Fortune 500.

All up, nearly 70% of the Fortune 500 now use Microsoft 365 Copilot and customers continue to adopt it at a faster rate than any other new Microsoft 365 suite.

For a company to release products and upsell them so quickly as they’re still being developed is one of the best advantages in technology history.

Satya also provided a fascinating insight into thinking about model investments moving forward:

“So ultimately, even with all the scaling laws and what have you, I think you ultimately will normalize to having a pace…You will want to sort of keep on that curve, which is you really want to refresh your fleet with the Moore's Law every year and then effectively depreciate it over the period of the lifecycle of it. And then the inference demand ultimately will cover how much we invest in training because that's, I think, at the end of the day, you're all subject to ultimately demand.”

Based on Satya’s commentary, the initial skyrocketing of AI demand is being caught by supply, and CapEx investments will more closely correlate to current AI demand starting next year.

AWS

The most notable news from Amazon’s earnings was the rapid growth in CapEx, even compared to the other hyperscalers. Up 81% Y/Y, and Jassy said they continue to be capacity-constrained on AI demand.

Amazon has also moved full-steam into AI applications with their Amazon Q platform. They specifically highlighted their code generation capabilities:

At the application or top layer, we're continuing to see strong adoption of Amazon Q, the most capable generative AI-powered assistant for software development and to leverage your own data. Q has the highest reported code acceptance rates in the industry for multiline code suggestions.

An interesting comment from Jassy was on Amazon Q Transform, a service to help expedite enterprise software migrations. This was a trend also called out by MongoDB, and I think this further decreases the moats in software.

GCP

GCP continued to accelerate growth. As I’ve said before, we typically don’t get any insights from the earnings calls on why GCP performs well or poorly. Google is a search business first, so most analyst questions are focused on search, as they should be. With that being said, we did get a few interesting points:

“This quarter, approximately 60% of that investment in technical infrastructure went towards servers and about 40% towards data center and networking equipment.”

“As you think about the next quarter and going into next year, we will be investing in Q4 at approximately the same level of what we've invested in Q3, approximately $13 billion. And as we think into 2025, we do see an increase coming in 2025, likely not the same percent step-up that we saw between 2023 and 2024, but additional increase.”

“Gemini API calls have grown nearly 14x in a six-month period.”

Some Final Thoughts

I’ll be sharing some more historical case studies in the coming months. In many ways, AI follows the hype cycles of the past with a big bang moment, a rapid influx of capital, and early positive feedback on that capital. I think the most unique variable about AI is the impact of the hyperscalers.

While infrastructure buildouts of the past have frequently been fueled by debt, this buildout is fueled by some of the most profitable and dominant companies ever to exist. This adds a variable we haven’t seen before, and I think the effects of this will continue to lead to interesting impacts on markets.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.