Q4 '23 Cloud Update

Market Share, Momentum, and AI Strategy between AWS, Azure, and GCP

Cloud is the industry I’m most invested in and the industry I’ve spent the most time studying. I like to provide a quarterly update on the state of the market & trends I’m seeing play out.

My goal for this article is to provide market share data, growth rates, and break down each of the cloud provider’s quarters. With AI being so important to the cloud, I’m going to summarize each company’s AI strategy as part of the quarterly breakdown.

One final note: I’m a Microsoft employee, and I try to be as unbiased as possible in my breakdown. The main biases come from knowing more about Azure than other clouds. Also, when I break down these trends, these are just my opinions based on my analysis. Please consider them as such. I can always be wrong.

Table of contents

Market Share Update

Market Share Momentum

AWS Results

Azure Results

GCP Results

Conclusion

Market & Market Share

Overall revenue between the 3 cloud providers grew 20.7% YoY, up from 19.1% in both of the last two quarters. Additionally, net new revenue was up YoY for the first time in 5 quarters pointing to a strengthening cloud market. This is primarily driven by slowing cloud optimizations as noted by all three companies.

A note on methodology: I use all of AWS revenue and all of GCP revenue. GCP includes Google Workspace, however, I haven’t found good data on how much revenue Google Workspace contributes to the segment. I don’t want to arbitrarily pick a %, so it’s important to note that GCP’s market share number in this chart is higher than in actuality.

Azure is the interesting one. I use Microsoft’s definition of Azure, which includes most of their cloud services but not their server products like SQL and Windows Server. While Microsoft doesn’t release their Azure revenue, we have a good idea of that number. First, they announce Azure growth every quarter and Microsoft Cloud revenue every quarter. Additionally, in the October earnings call, Satya noted: “The Microsoft Cloud surpassed $110 billion in annual revenue, up 27% in constant currency, with Azure all-up accounting for more than 50% of the total for the first time.” With that information, we can estimate Q2 2023 (calendar year) and fiscal year 2023 Azure revenue. Then, we can extrapolate using known growth rates.

While the trends will be correct, please consider the actual numbers with a margin of error.

We can visualize market share more simply here:

Azure and GCP took share in Q4. Azure’s market share gains came in large part from AI, which contributed 6 points of growth to Azure which works out to about $800M in AI revenue this quarter using $4B in net new revenue.

GCP’s gains seemed to be a rebound to former trends, buoyed by AI and fiscal year dynamics of Q4 being the strongest quarter for these companies. AWS continues to be the slower-growing industry leader focused on providing the lowest cost compute and storage but with less upside from AI and managed services.

Breaking down market share by net new ARR gives us even more color into cloud market share momentum.

Market Share Momentum

Market share by net new revenue gives us the clearest idea of where market share is headed. We can visualize cloud market share momentum here:

If we compare these numbers to a year ago:

AWS: 42.1% -> 32.4%

Azure: 37.1% -> 46.1%

GCP: 20.8% -> 21.5%

Azure has had the best year of the cloud providers, largely at the expense of AWS.

Several dynamics are causing this. First, AWS is the most exposed to software companies born in the cloud. A large number of these are SaaS businesses, which have not re-accelerated growth rates after the slowdown in 2022. Second, Azure has benefitted the most from AI. It’s arguably the most important avenue of growth for the software companies. The race is in its early innings but it’s unclear if AWS can regain market share. More on Amazon’s AI strategy later.

Third, AWS has focused on a higher-margin strategy aimed at delivering compute and storage services. They haven’t invested in managed services as much as the other clouds. This has led to slower revenue growth but a more profitable business than their competitors.

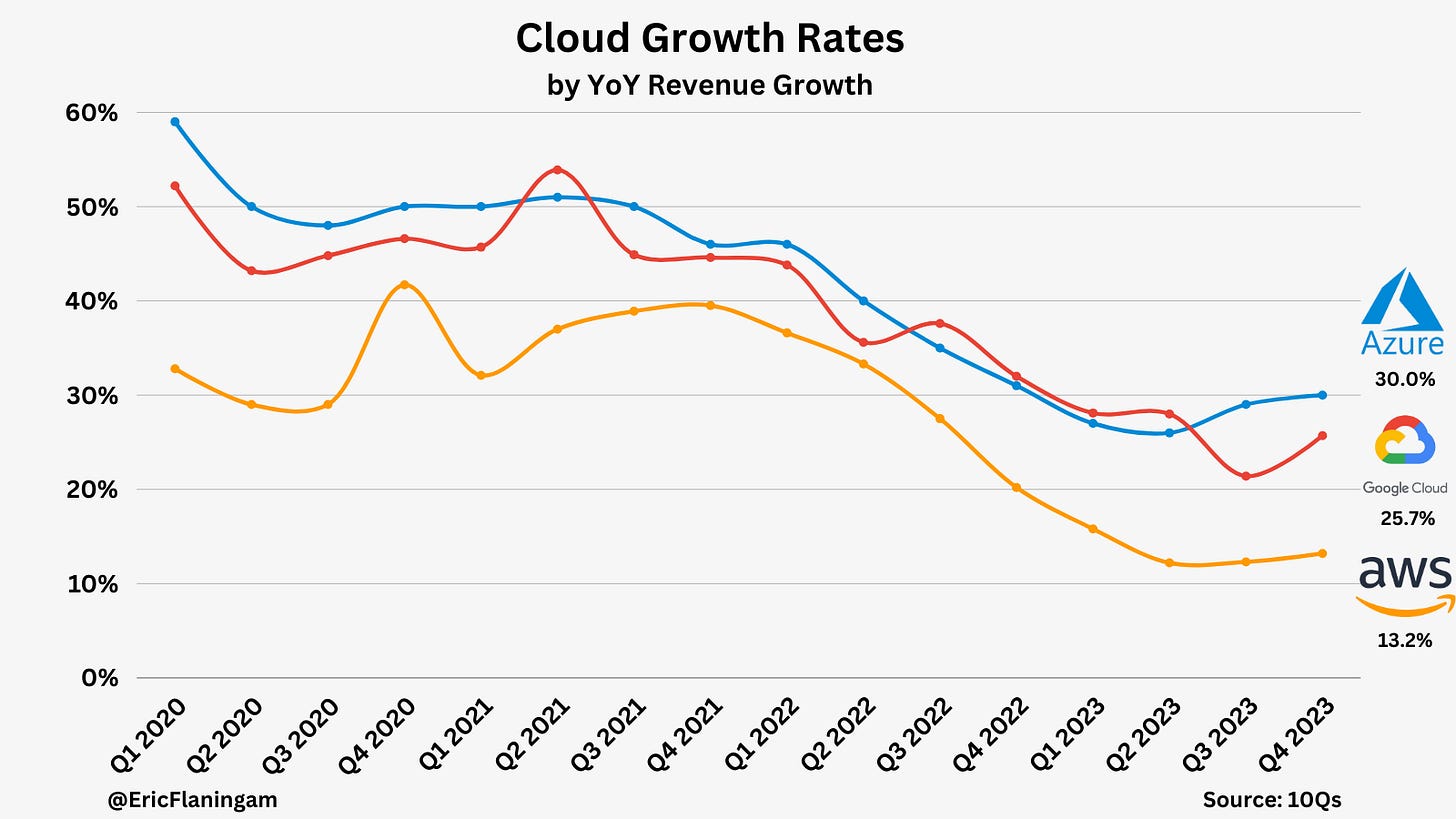

Other dynamics are at play, but these are the major ones as I see them. The cloud growth rates are further evidence of these dynamics:

All three companies accelerated growth rates. Keep in mind, that without AI, Azure would be growing at 24% YoY. It’s not just hype.

AWS

AWS re-accelerated growth, giving hope to investors. It seems as though expectations have been permanently reset for the business. At the turn of the decade, perhaps it seemed to be a business that could grow at 20+% for a decade. Now, that estimate seems to be more like 10+%.

See above for dynamics on why that has occurred. At some level, compute power is commoditized. While AWS is well positioned to continue leading compute and storage costs, Azure and GCP see their growth coming from additional services in Data, AI, and Security. The clear growth avenue for cloud is AI; while AWS was slow out of the blocks, they have the right strategy:

Silicon:

At the bottom layer, where customers who are building their own models run training and inference on compute where the chip is the key component in that compute, we offer the most expansive collection of compute instances with NVIDIA chips…We've built custom AI training chips named Trainium and inference chips named Inferentia.

AI as a Service

In the middle layer, where companies seek to leverage an existing large language model, customize it with their own data, and leverage AWS' security and other features, all as a managed service, we've launched Bedrock, which is off to a very strong start with many thousands of customers using the service after just a few months.

Applications

At the top layer of the stack is the application layer, one of the very best early Gen AI applications is a coded companion…we launched Amazon Q, which is an expert on AWS, writes code, debugs code, tests code, and does translations.

This full-stack approach is a good strategy, but we haven’t seen any results from it yet. We don’t have much data on the performance of Bedrock. As far as AI applications go, CodeWhisperer is competing with Github Copilot, who is by far the market leader. AWS Q has just launched and will be valuable, but the path to revenue generation isn’t clear.

With AI, AWS has the right strategy, the question comes down to execution. I don’t think that’s a question any of us can answer right now.

Azure

Azure continues to outperform, in large part due to AI. Last quarter, 3% of growth was attributed to AI, that number is 6% this quarter. Based on estimated net new revenue, that’s growth from $380M to $800M quarter over quarter. Most of that revenue came from Azure OpenAI API usage.

Some highlights from the quarter:

We now have 53,000 Azure AI customers. Over one-third are new to Azure over the past 12 months.

Cosmos DB data transactions increased 42% year over year.

Data stored in Fabric's multi-cloud data lake, OneLake, increased 46% quarter over quarter.

GitHub revenue accelerated to over 40% year over year, driven by all our platform growth and adoption of GitHub Copilot, the world's most widely deployed AI developer tool. We now have over 1.3 million paid GitHub Copilot subscribers, up 30% quarter over quarter, and more than 50,000 organizations use GitHub Copilot.

Azure’s AI approach is based on the “Copilot Stack”. If a customer just wants applications, they can buy Copilot (or one of the many variations). If a customer wants to build their apps, they can use Azure OpenAI. If a customer wants to train their own models, they can leverage Microsoft’s partnership with Nvidia for data center GPUs:

Microsoft continues to execute on revenue-generating AI applications better than any other software provider.

GCP

Finally, on to GCP. They had a strong quarter, showing re-acceleration back towards their historical trendline. So, why did they outperform? It’s hard to say because the earnings calls give little insight into cloud performance.

With that being said, I’ve been impressed with GCP’s leadership team. If you’re a Google investor, it’s worthwhile reading these interviews with Will Grannis (CTO of GCP) and Thomas Kurian (CEO of GCP).

Will breaks down GCP’s strategy into focuses on infrastructure, data & AI, security, and collaboration. He further breaks down GCP’s AI strategy and it’s the same as AWS’ and Azure’s: infrastructure, platform, and application. This is a quick summary and I encourage you to read both of those interviews, it will certainly give you more confidence in the technical leadership of GCP. However, this brings me to the last point for GCP.

There seems to be a disconnect between Google leadership and GCP leadership. I continue to read about how strong Google’s AI technology is and how their TPUs are a legitimate competitor to Nvidia’s GPUs. Yet, we aren’t seeing the revenue generated from this (or at least management isn’t telling us about it). I don’t want to speculate on why this is, because there could be hundreds of reasons. However, it’s challenging to be an uninformed shareholder and that’s the position Google puts us in. It seems possible that GCP is being led without much influence from the other Google executives. If this is the case, it’d be worthwhile bringing Kurian on to the earnings calls. But I digress. It was a strong quarter for GCP, and hopefully, we get more cloud insight in future quarters.

Conclusion

We’re in a fascinating situation right now with the AI cloud race. Cloud is logically a crucial chokepoint for AI. All three companies are pursuing similar strategies, a full-stack approach of applications, platforms, and infrastructure. All three companies have essentially unlimited funding to pursue those strategies. The end result will come down to who can execute.

I have a feeling a great book will be written one day on how companies can execute in the birth of new markets featuring *cloud company that ultimately wins AI market share*.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. I’m a Microsoft employee, all information contained within is public information or my own opinion. I hold shares of Microsoft, Amazon, and Google.

Nice summary Eric!

Nice article! Do you have any insights into which cloud new startups are chosing?

At this moment everyone is moving to the cloud, both legacy business as well as start ups. So the future prospects of any cloud can not yet be fairly assessed with the total growth figures at this time.

As the majority of businesses get replaced by newcomers over time, the cloud that’s most attractive to these newcomers will be the one that wins in the long run.

Since Microsoft has been around for so long I wonder how much of the growth that’s presented here consists of such legacy businesses?