Salesforce & AI Strategy

A deep dive on the CRM Company, AI's role in its future, and potential shifts in software value chains

I ended my last article saying that a mediocre answer to a great question is more important than a great answer to a mediocre question.

One of those important questions I’ve been thinking about is: How do established software companies’ advantages play out in the age of AI?

Given the rise of AI, agents, and Salesforce’s focus on both, Salesforce feels like a good case study to help answer that question.

To start, Salesforce’s AI strategy thus far has been excellent.

Leverage their data, distribution network, and brand; go all-in on marketing Agentforce.

At the same time, Salesforce’s software is notoriously complex. They’ve got more competition now than ever before.

So this will be a deep dive into Salesforce: its history, what made it successful, the state of the business, and the AI opportunity (or threat) today.

Ironically, the Salesforce story largely lays out the strategy to take on large incumbents, so we’ll start there (with a preview of the story below):

Without further ado.

The Story of Salesforce

As we go through Salesforce’s story, I want to highlight four central themes to keep in mind:

Getting the right idea at the right time is really, really important.

There’s no such thing as too much marketing, as long as it’s got a clear message.

The bigger the platform, the higher the switching costs.

Once you have the platform, expand it to as many adjacent markets as possible.

Much of this section came from Marc Benioff’s books on Salesforce.

The Founding Story (Lesson #1: The Right Idea at the Right Time)

Just like Phil Knight and Sam Altman, a sabbatical helped plant the seeds of Marc Benioff’s success. Marc had spent thirteen years working under Larry Ellison at Oracle, where he had risen up through the ranks. He decided to take several months off to think about his career.

At that time, Amazon.com was exploding, and Siebel Systems (on-prem CRM) had IPO’d. Marc was an investor in Siebel and knew the insider flaws with the product.

Combining the two ideas, he came up with the idea for an online CRM: “Amazon.com meets Siebel Systems.” Companies would no longer need to buy on-prem software, set up servers and networking, install the software, and have expensive contracts to fix the software when it went down.

With Salesforce’s launch in 1999, it became one of the first widely available cloud software products.

The Early Years (Lesson #2: There’s No Such Thing as Too Much Marketing)

Salesforce has always been an innovative sales and marketing company. This has been true from the very beginning.

Salesforce pioneered the cloud software model, but customers didn’t really get it. They didn’t see the point in it and didn’t trust its reliability or security.

From the beginning, Marc and Salesforce understood the importance of marketing: “Always ask yourself, "What's my message?" Position yourself either as the leader or against the leader in your industry.”

Salesforce did just that, launching their initial campaign of “The End of Software.” Companies would no longer need to buy software; they could now “rent” their software and remove the upfront cost and headaches of on-prem software.

Most of the Salesforce team hated the idea. But, in Marc’s words,”I felt that their arguments were overruled by the most important rule in marketing—the necessity to differentiate your brand.”

Famously, Salesforce hired fake protesters to set up shop outside of a Siebel Systems conference. They then hired journalists to go interview those protesters. Marc’s motto was “always, always go after Goliath.”

In 2003, Salesforce would host their first Dreamforce event as well, which would go on to become the most successful annual software conference in the world.

And this all caught on like wildfire. Once customers saw the value of not managing on-prem software, Salesforce took off. When people talk about PMF, this is what it looks like. By the end of 2003, Salesforce would do ~$100m in revenue, just four years after founding. Those are AI-like numbers!

Becoming a Platform (Lesson #3: In Software, the bigger the platform, the higher the switching costs.)

The bigger the platform, the higher the switching costs. The root of Salesforce’s (and enterprise software’s) moats are switching costs. Even if they don’t offer the best product, nobody else has been able to offer a better enough product to convince users to switch. This started with advice from Steve Jobs himself.

Planted by advice from Steve Jobs, Marc began focusing on building an ecosystem around Salesforce. Steve told Marc that he needed to build an application ecosystem for Salesforce. So, Marc came up with the name “The App Store”, but his team disapproved, so they changed the name to “AppExchange.” When Steve was ready to launch the App Store, Marc gifted the domain name back to him.

AppExchange would become one of the first early product expansions for Salesforce in 2005. Developers could now build applications on top of Salesforce, and it even had its own programming language.

For an idea of the legitimacy of this platform, Veeva ($37B public company) built its platform on Salesforce. They didn’t officially decide to move off of it until last year.

Inorganic Expansion (Lesson #4: Acquisitions should have clear strategic value leveraging the existing strengths of the acquirer.)

In 2008, Salesforce passed $1B in revenue, approximately a decade after being founded. At this point, they were becoming the market leader in the CRM market. The cloud is taking off. But, Salesforce needed to expand to continue this growth.

So they started a series of acquisitions to expand into adjacent markets.

Many of these acquisitions are good lessons on real acquisition synergy: leverage existing advantages (data and distribution network), expand into a new market, and upsell that new product with your advantages.

In 2006, Salesforce would make its first of mobile startup Sendia. This would start its tradition of entering a market via acquisitions. Up to today, it would do the same with:

Heroku for PaaS services

ExactTarget for Marketing Automation

Demandware for E-commerce

Tableau for data visualization

Slack for enterprise messaging

Most of these clearly add a new vertical with new customer data or a new way to communicate with customers that fits naturally into Salesforce’s portfolio.

Those acquisitions mostly catch us up to speed and tell the root of Salesforce’s story.

Salesforce has continued to expand market share in their core markets, growing to a market cap of $230B and playing out the natural evolution of an enterprise software company: grow revenue, become more profitable, and create shareholder value!

Salesforce: A Platform of Platforms

I won’t spend much time on their technology, but I will provide a quick overview for the purposes of our discussion.

The basic idea everyone has of Salesforce is that it is a database with pre-organized dashboards and customizable business logic for sales teams. This is true and a testament to the clarity of branding mentioned earlier.

But actually, less than 25% of Salesforce’s revenue comes from their “sales cloud.”

So the right way to think about them is a database for all of a company’s customer-facing organizations: sales, customer service, marketing, and eCommerce.

Salesforce sales cloud: account data

Customer service cloud: incident management data

Marketing cloud: marketing data

Commerce Cloud: e-commerce data

Then, there’s a platform layer, made up of data services and an application builder. Data includes a warehouse-like service for unifying data storage, Mulesoft for integrating all of those various data sources together, and Tableau for visualizing data from those sources. Slack is also in there, but it doesn’t really fit so cleanly in the portfolio.

Agentforce

Finally, Salesforce’s current area of focus is Agentforce, their AI agent offering. They offer agents with pre-defined workflows for customer service, sales, and marketing, as well as an agent builder product.

As Salesforce’s head of AI describes:

Agentforce basically has pre-built automations in the form of AI agents for their various workloads. So Agentforce and what we built is a mixture of effectively out-of-the-box agents that mirror kind of our lines of business or clouds, right? So service, sales, commerce, marketing, et cetera. And so we think about having agents doing all kinds of like long tail type background work. Really unstructured data is -- I don't want to say gold mine, but it's something now that we can do so much more with all of the data, transcripts.

The most popular use cases today are in customer service and sales:

So I think service is maybe the most obvious as you're pointing out, kind of almost like it's low hanging fruit, but it comes up a lot. Another really kind of big interesting use case is really about more on the employee side, like internally facing agents that are doing basically pre and post like meeting prep. We have an SDR product, sales development rep product that takes leads. Your sales plan does research on the leads and it does outbound e-mails to them. So we have 5,000 Agentforce deals in Q4. About 3,000 of those were paid.

Bringing it all together:

CRM: A Market of Giants

One other important point to highlight is the top-heavy nature of the market. Salesforce is undoubtedly the CRM leader. But, second, third, fourth, and fifth place are all massive, incumbent enterprise software companies.

Salesforce’s biggest competitors are Microsoft, Oracle, SAP, and Adobe.

Okay, forgive me for skipping over some of the details here. But as I said, Salesforce is the canonical example of an enterprise software company. Low churn, consistently decreasing revenue growth (as expected), and increasing profitability:

CRM epitomizes big, mission-critical software that nobody wants to switch off of.

Given that this article is asking the question of how incumbent advantages play out in AI, the switching costs of CRM provide the perfect case study on it.

What’s the Outlook for Salesforce?

The bull case for Salesforce is that Salesforce’s switching costs, data advantages, and distribution network are strong enough that Salesforce adds another multi-billion dollar product line and creates an additional layer of value with their AI offerings.

But, the more interesting question is, what if that doesn’t happen?

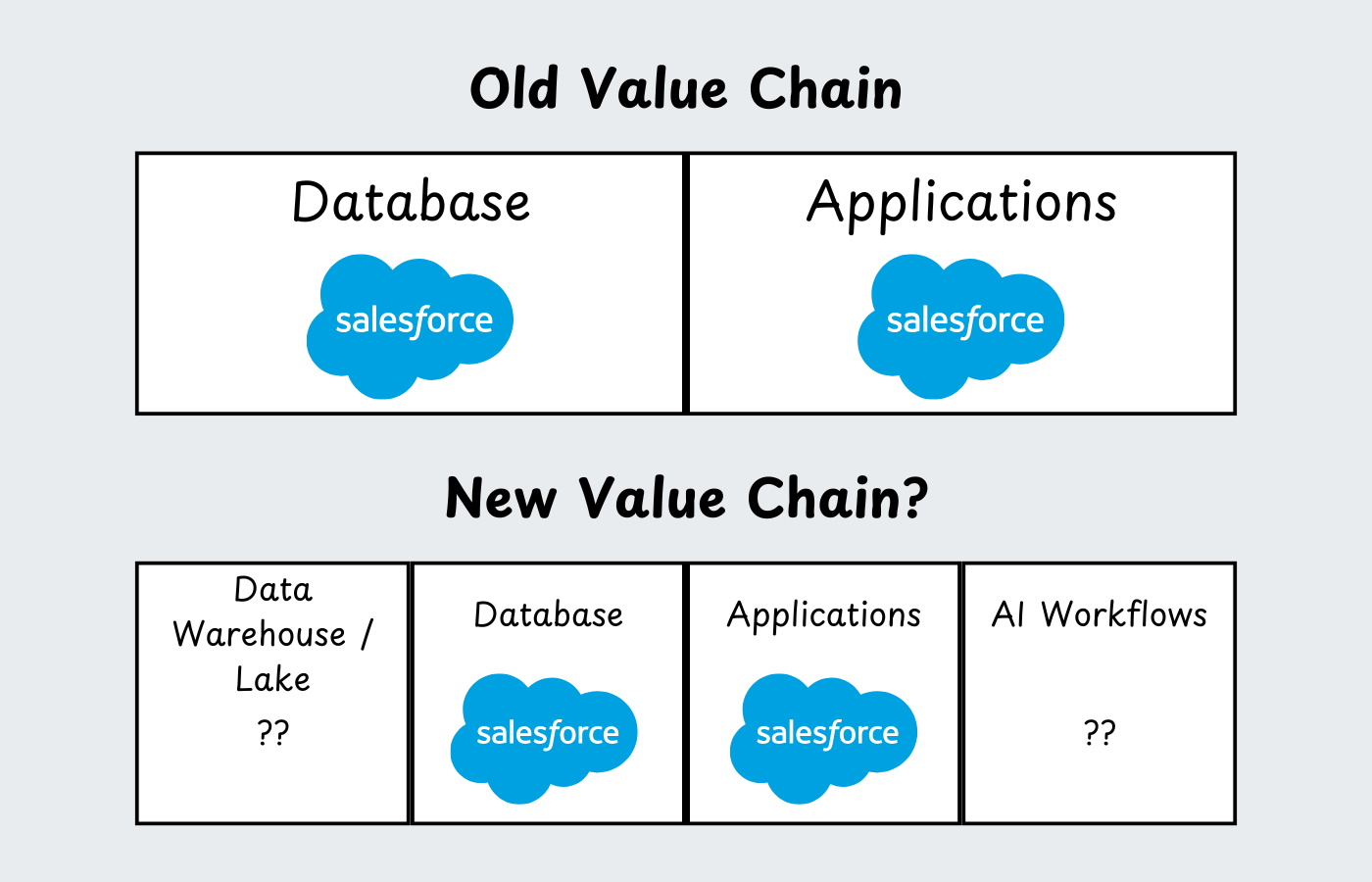

I think the greatest risk to Salesforce is not head-head competition but a shifting of value in the value chain. In this scenario, value shifts from the “CRUD databases with business logic” in Satya’s words to new data storage and new workflows.

The current model of CRM is simple: store customer data and have applications (sales, customer service, marketing, eCommerce) built on top of that.

A very interesting data point came up from Packy McCormick’s deep dive on Rox: data has been shifting from the CRM to the data warehouse over the last five years. Up to 40% of the data stored in data warehouses is customer data. What that means is that the CRM database may be losing some of its position in the value chain.

If this is true, then the value from data storage may shift to lakes & warehouses. With the rise of agents, application value may shift to agentic workflows:

Despite this being several years out (if it happens at all), I think it’s the threat that Salesforce is most concerned about (and I think it’s informing their data strategy with Zero Copy Partner Network and Agentforce).

This is a conversation not just about Salesforce, but about the future of enterprise software. Software is meant to automate workflows and make us more productive. If agentic workflows can do that more efficiently, then value is likely to shift there.

With that shift, the new value chain may look much different from the old one.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

I have a copy of Benioffs first ever V2MoM from 1999 - gold dust - I should send you a copy. Thinks about Values completely differently to any other Strategy Framework ✅💲

Thanks for this - seems plausible that in the not too distant future the application layer is entirely defined by business users through prompts and these sorts of applications are reduced to data stores.