The Future of Foundation Model Business Models

What’s the path to profitability for OpenAI, Anthropic, xAI, and others?

With Anthropic’s new funding round, three foundation model companies are now three of the ten most valuable unicorns in the world.

But over the last three months, DeepSeek was released (showing cost improvements from distillation for training and algorithmic improvements for inference). Grok-3 was released, providing top-tier performance and again making it unclear how to sustainably differentiate at the model level.

So there’s a divide between expectations of future economics and the reality of economics today that leaves us with the question of how do you bridge that gap: what’s the path to sustainability?

This isn’t without historical context. Capital-intensive, transformative technologies from canals, to railroads, to the electric grid, all required high amounts of capital and often took many years to develop sustainable economics.

Charlie Munger himself said this about railroad stocks: “Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy.”

This article makes a very important assumption: the foundation model companies will find a path to sustainability. They are clearly the new enabling technology of the AI wave. The question is not an if, but a how.

That’s what this article explores today.

OpenAI and the Current State of Affairs

Let’s start with the current state of affairs, at the largest of the foundation model companies.

OpenAI was expected to generate ~$4B in revenue in 2024, with a $5B loss.

On that $4B in revenue, their gross margin was approximately 41%. I speculate that number only includes hosting and inference costs (but someone correct me if they know otherwise).

They do expect that margin to improve to 67% in 2028 (not your grandpa’s software margins eh!) They expect to hit profitability in 2029 when their revenue surpasses $100B.

So, if it will take $100B in revenue to hit profitability, what’s the path forward?

The answer to that comes from a very interesting chart:

Now, this chart is particularly redeeming for OpenAI in the context of the DeepSeek announcement. Their path to $100B in revenue doesn’t run through the API; it runs through applications.

Even in 2025, it expects “new products” to surpass API revenue, which we’ve come to learn refers to agents.

The key point here is that OpenAI is an application company with its models as its differentiator.

What this means is that they do not have to offer an API to maintain their position as the leading AI company. That would be bad for the AI community. It would be bad for OpenAI, but they may not have a choice.

The Business Model Options

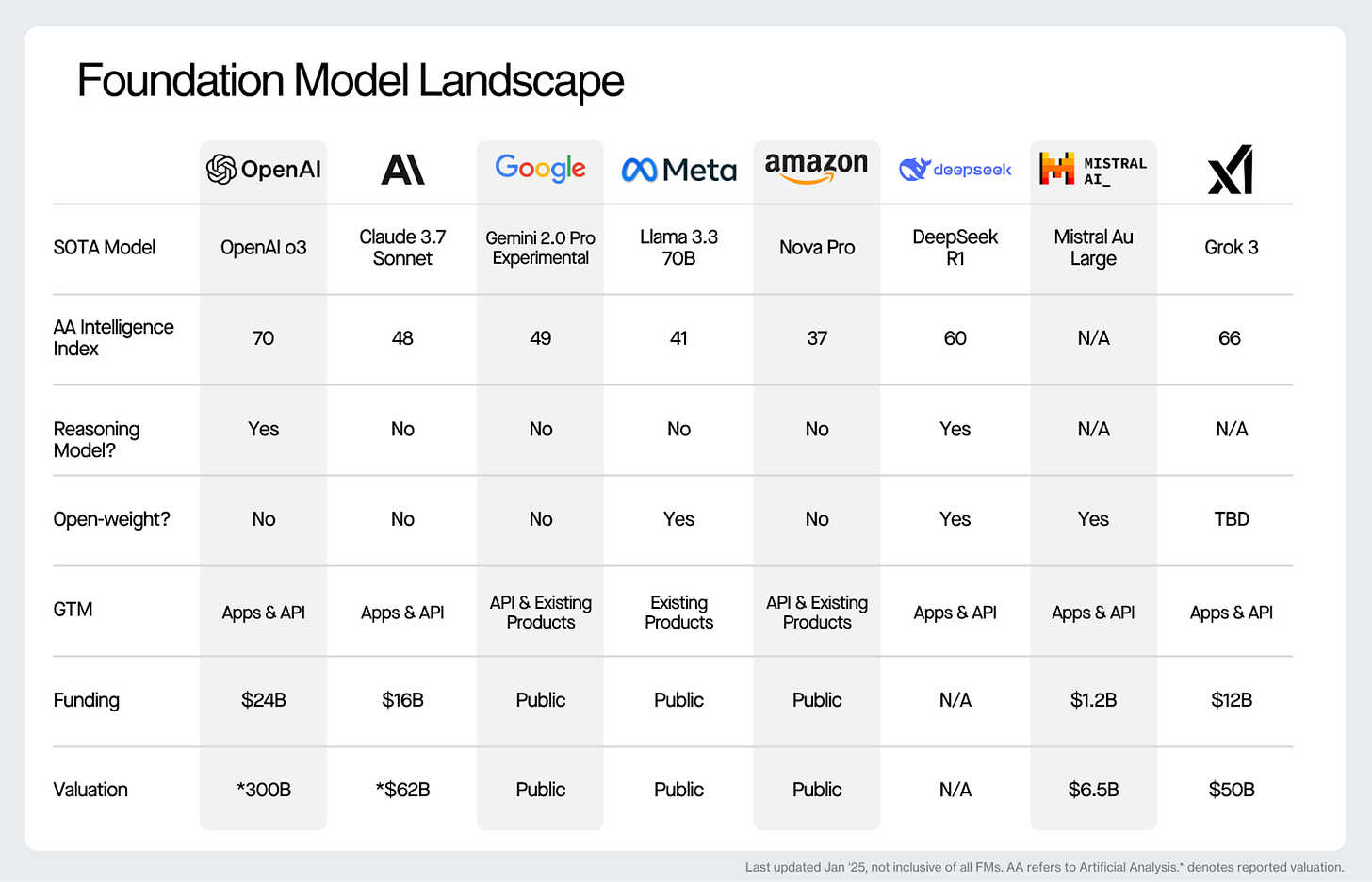

Broadly, several major AI research labs/alliances have emerged for leading-edge LLMs.

Each with unique advantages and business models:

The companies competing in the foundational model race have three business model options:

1. Sell an API to your models and bet you have the most performant model.

“In economics, a commodity is an economic good, usually a resource, that specifically has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.”

Without model differentiation, APIs can easily be switched in and out like a commodity. There’s no shortage of funding or competition at the model level:

Foundation model companies: Foundation model companies have raised over $50B to develop models.

Hyperscalers: The most profitable tech companies to ever exist are competing in the space. Additionally, AI creates a gigantic new market for these companies to take on. They’ve been expanding to whatever areas they can with incremental investment opportunities becoming rarer and rarer, until AI! Now, they have a huge market opportunity and a threat of disruption. Both carrot and stick!

Potentially other competitors via distillation: DeepSeek and distillation provide yet another path for model commoditization. It also results in the leading-edge models essentially funding AI progress while other companies can distill and charge less for their products.

A race to the bottom with hundreds of billions of dollars available to fund that race is not an attractive business model in the short-medium term.

2. Commoditize your complement and allow value to accrue to existing products.

There’s another path that companies like Meta are pursuing: commoditize your complement.

The fundamental idea of commoditizing your complement is that a value chain acts like a water balloon. If you commoditize one layer of the chain, you squeeze all the value out of it (no profits), and that value flows to the rest of the value chain.

Google owned search, expanded to Android and gave it away for free. Nvidia owned the GPU, expanded to CUDA, and gave it away for free.

This starts with a strategy like Meta open-sourcing Llama. They already have a distribution network to profit from. They aim to make as good of a model as possible and use the open-source community to make it even better. They then profit through advertising to their network of over 3 billion users.

The big tech companies can pursue this path and profit through existing applications. New age foundation model companies can not.

3. Pursue vertical integration and enjoy the margins from integrated services.

The generalized equation for vertical integration is this: A company solves the hardest part of the value chain, which creates a moat -> company expands across the value chain and provides integrated services at a higher margin.

SpaceX owned the launch business, then expanded to Starlink. IBM owned the mainframe, then expanded to software and services.

This provides the clearest path for the AI research labs: create differentiation from models and create profitability from applications.

So, the API path is increasingly looking like a commodity. Incumbents have existing products and distribution networks, so they can play the commoditize-your-complement game.

One path forward for the new-age companies: vertical integration.

The Path Ahead

We’re talking about business models, so how does vertical integration create a path to a sustainable business model?

Vertical integration allows you the traditional product and margin benefits from vertical integration, but more importantly, it allows a company to build application-like moats around your product.

An API is a race on model price/performance that can be switched out at any time. With apps, you build moats like software companies did: distribution networks and switching costs.

It allows a company to protect margins and expand margins by taking advantage of the decreasing cost of inference.

It provides a company the OPTION to only offer leading-edge models through the application.

As applications integrate into more systems and store more user data, the switching costs increase even more.

The application layer becomes something akin to a distribution network for the model, whether its chatbots, robotics, or vehicles.

The last strategy to note is one akin to the luxury handbag market.

The foundation model companies could choose which markets they want to address with their applications (i.e. general purpose assistants, robotics, vehicles).

They could then choose select partners in vertical markets (legal, healthcare, finance) and only offer leading-edge models through exclusive sales relationships. This (1) increases demand and pricing power, (2) prevents distillation by not making the best models publicly available, and (3) locks in customers to multi-year contracts.

From there, they can open-source their lagging-edge models which gives them support with developers and the open-source community.

This strategy:

Creates profitability at the application layer.

Improves economics at the API layer and prevents distillation.

Offers a path to still support the open-source community.

Perhaps we’re ahead of ourselves and the foundation model companies will need to raise hundreds of billions of dollars on their path to sustainability (OpenAI is in talks to raise $40B more right now!)

Over time, model innovation alone won't build sustainable businesses - but it might power the applications that do.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Great piece, thank you. How about OpenAI's relationship with Microsoft: is it relevant at all?

“The key point here is that OpenAI is an application company with its models as its differentiator.” … are the models actually the differentiator? Or might it be the benefits of being the incumbent — brand and distribution? The mass market user might not be comparing models and switching when one is better (model differentiation); rather they just stick with the first app they used (ChatGPT).