Toast: A Recipe for Building a System of Record

A Deep Dive on the Vertical Software Company & Lessons on Building AI Companies Today

As I’ve been studying the healthcare industry over the last several months, one quote from Abridge’s CEO stood out to me:

“So if you really believe as we do that healthcare is about conversations—that it's one of the first original signals in healthcare—then you start to see that any number of different workflows are beyond it.”

Implicit in this statement is the idea that you can own a key workflow, then backwards integrate into becoming the system of record (the “single source of truth” system that stores the most important data for companies).

Contrast this approach to the systems of record today (Salesforce, ServiceNow, Workday, SAP, etc.), which started as databases and expanded into applications.

But companies resemble the technology wave they ride in on. The last wave of software (SaaS) was built on the structured database. This wave is built on the unstructured workflow.

Charlie gave us the advice,”Pick an extreme example and ask what the hell happened here?”

This brings us the extreme example at hand: Toast.

They took what may be the hardest customer set of any industry (small restaurants), owned the most important workflow (orders), expanded as a platform (became the system of record), and became a $25B company in the process.

Their journey lays a playbook for companies, especially in vertical industries, to build a new system of record.

See a summary of that journey here:

Also I'm working on a project documenting the stories of founders of companies like Toast, and compiling a booklet of their lessons. If you happen to have an intro to one of those folks, it'd be much appreciated. You guys are the best.

Onward.

The Story of Toast

Toast’s starts at Endeca, a database search engine founded by Steve Papa that Oracle acquired for over $1B in 2011. Three leaders (Steve Fredette, Aman Narang, and Johnathan Grimm) had spent years talking about starting a company together.

After the acquisition, they were, as Aman put it, “shamed into starting a company” because they’d talked about it for so long.

They get the idea that ordering food takes too long, so they’re going to build an app that allows you to order from your phone (scanning a QR code at restaurants). They go to raise money, and VCs do not want to invest. Restaurants are terrible customers, contract values are small, and the founders are arguing with each other in meetings. The only person willing to invest is Steve Papa, a $500k check at a ~$3M valuation. That stake would eventually be worth over $3B.

In 2012, they launched the app. Nobody really wants it, it solves a problem people don’t really care about. But what they do realize is that once they get the order, they can’t really send it anywhere because the Point of Sale systems (where you swipe your card and waiters put in your order at restaurants) are all on-prem and closed off from integrations.

So, for restaurants to be able to move into this new wave of mobile ordering, they were going to need new point-of-sale systems. Those systems happened to manage the most important data in the restaurant: the order.

1. Own the key workflow

So, in 2013, Toast launched their cloud-based Point of Sale system. They made two key decisions early on in their development:

Building on Android, not iOS, for maximum flexibility to accommodate the complexity of restaurants

Integrating payments into the point of sale, allowing them to create another revenue stream (and aligning their incentives with the restaurants). They essentially offer the same rate as existing payment processors and got little to no pushback.

They had immediate and violent product-market fit. As Arman described it, "We would go in and pitch our app, and people wouldn’t really care. But when we asked about their point of sale, they would talk for hours about how much they hated it."

By the end of 2015, they had 1000 customers. The complexity of restaurants (orders, inventory management, table management, payroll, high employee turnover, marketing) became their opportunity, and they immediately started building out features around the PoS.

2. Once you have the key workflow, expand to the most painful applications now unlocked by the unique data

After they had the PoS data, they could solve problems that were previously impossible to address: kitchen display systems and order routing, replacing paper tickets. They also offered features that solved the biggest problem all restaurants face (generating profits): digital gift cards, points-based loyalty programs, and online ordering.

There’s no replacement for good old-fashioned product velocity.

In Bessemer’s 2015 memo, they shared, “First off, the sheer amount of software the team has built in a short span is impressive – feature for feature they are already much more in the class of the >20 year old enterprise systems than the next gen “Bistro” players, and so for restaurants with any level of sophisticated feature requirements they win easily.”

Then, in 2015 and 2016, they showed the path they’d execute on for the next decade:

Build product functionality to move up market (multi-location management)

Expand the horizontal functionality to become the system of record for restaurants

In 2016, they released inventory management and food cost tracking, connecting front-of-house data with back-of-house data. At this point, they had solved the most important problems in the restaurant. The next step was to become a platform for others to build on.

3. Build an ecosystem for other companies to solve the problems you can’t

Due to the complexity of restaurants, there were still a lot of problems to be solved. And Toast couldn’t solve all of them, so they started to create an ecosystem.

They offered an API to allow developers to build with Toast’s data. This kept restaurants happy, allowed Toast to generate another source of revenue, and, most importantly, kept everyone in the Toast ecosystem.

“Basically several other startups we’ve seen in the restaurant space are simply modules on Toast. We think an app store model over time (a la Shopify) is possible and could contribute to Toast’s defensibility along with integration into several ecosystem players.” - BVP Memo

4. Expand to everything the customer needs

Their product velocity then continued until their 2021 $20B IPO. By then, they offered (among other features): payroll, labor management, handheld PoSs, marketing automation, and loans.

Even when COVID hit, and they thought they might lose it all, they released Toast Delivery Services, Toast Order & Pay, Toast Go 2. As the VCs say,“JuSt KeEp ShiPpInG.”

After their IPO, they’d offer products for: invoice processing (accounting), international products (UK, Ireland, Canada), hotels, retail (food & beverage), and catering.

Toast had become the Microsoft of restaurants, owning the most important workflows in the restaurant, starting with the one that mattered most: the order itself.

Which leads us to the final step: profit.

II. The Current State of Toast

Since IPO, Toast has done nothing but execute:

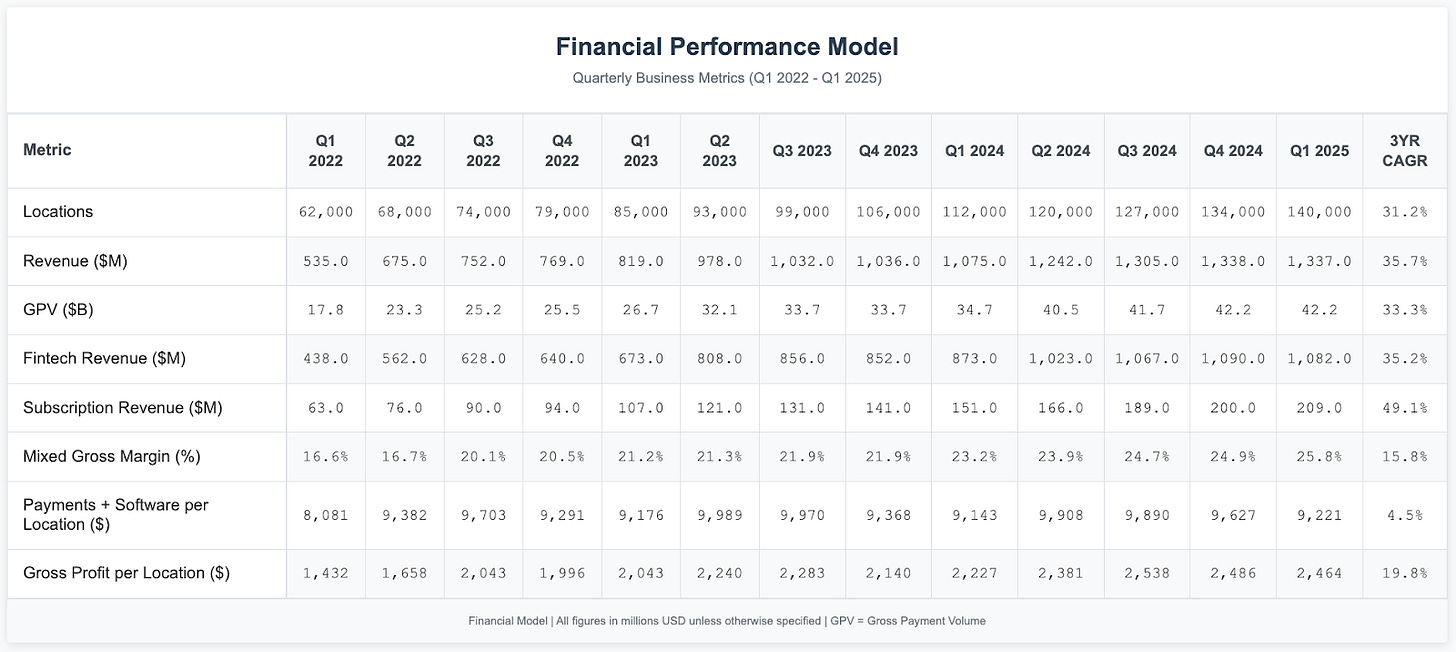

Location growth: 31% CAGR

Revenue growth: 36% CAGR

Gross payment volume: 33% CAGR

Improved operational efficiency: 20% gross profit CAGR

Net income: $56M last quarter

Today, Toast processes payments for roughly 25% of the 520,000 small and medium restaurants in the US.

Their revenue comes from two primary sources: 80% comes from payments (taking a cut of every transaction) and loans, while 20% comes from software subscriptions (60% and 40% of gross profit, respectively).

See their metrics over time here:

With a quarter of the SMB market already captured, the easy wins are gone. The question now is how much growth remains, which breaks down into three areas: market expansion, market share gains, and revenue per location.

1. Market Expansion: How Much Runway Remains?

Market expansion will come from three areas:

Upmarket expansion

Expansion to other verticals

International expansion

Upmarket expansion is the clearest opportunity. Toast already offers most enterprise functionality; the gap is primarily in customer support and service levels. Recent wins with Applebee's and Topgolf demonstrate early traction, though competing against entrenched enterprise vendors like NCR and Oracle requires different sales motions and longer cycles.

Vertical expansion beyond restaurants is possible, but significantly more competitive. Toast's core advantage has always been deep restaurant expertise.

International expansion is the final growth vector. As of May 2024, Toast had 2000 live international locations, so they’ve shown early success. Especially in markets where there are similar workflows to the US (Canada, UK, and Ireland). Expansion beyond these markets requires adapting to different payment systems, regulations, and operational practices.

Management shared the goal of 10,000 locations across these three segments by end of year, and it will be the most important metric to watch moving forward. If they can execute, they still have only touched a fraction of the global market, see a directionally accurate market analysis here:

Based on these numbers, there’s still $13B+ worth of addressable ARR and $7B within the US. This doesn’t include the potential to expand to more geographies and industries.

2. Competition: Can They Keep Winning?

Across all segments, Toast is the fastest-growing company in the space. Qualitatively, they win by being the best product for restaurants: the most features, the easiest setup, the best user experience. However, that varies by the needs of individual customer segments.

In micro-businesses, Square does well through its simplicity and cost. Will Schreiber from Business Breakdowns shared that customers below $50K tend to go with Square because they don’t need the additional functionality of Toast and can get started for less than $50 on Square with no monthly fee.

According to that same interview, over 60% of Square sellers process $125,000 a year or less, compared to an average of over $1M a year for Toast. Toast, on the other hand, is $70-$160/month with a little more expensive hardware. Toast becomes cost-effective ~$43k in annual revenue due to lower payment processing rates (about 30 basis points cheaper).

In larger chains (15+ locations), customers historically chose enterprise solutions like Revel (owned by Shift4, serving 200,000+ customers), Oracle, or NCR. However, as Toast expands functionality, this becomes much more addressable.

Finally, there are strong switching costs around point of sale systems and its surrounding software, and Oracle and NCR still have the largest market share in US restaurants. In addition, there are other competitors like Clover from Fiserv (targeting $3.5B in revenue this year), Lightspeed ($1.1B in revenue).

The market’s huge and the market’s competitive.

See an overview of the competitive landscape here:

3. Can They Increase Revenue/Location?

We’ve seen revenue growth outpace location growth since IPO (ARR/location CAGR of 5.7%). If we go back to 2015, they’ve grown ARR/location at a CAGR of 10%.

So, they’re likely to continue expanding that number, albeit at a much slower pace than their location and revenue growth.

Finally, AI offers a new and clear expansion path: customer service, phone answering, and drive-thru ordering are all in play and have been mentioned by Toast.

In summary, the market Toast is taking on provides plenty of room to grow in my opinion. But the execution risks increase with each new market they enter. After twelve years of execution, they’ve earned the benefit of the doubt.

III. Some Takeaways from Toast’s Journey

As I think about the takeaways, the big lessons, the playbooks to take away from Toast, I’ve narrowed that down to three thoughts (and one application):

1. Toast Laid out the Ideal Playbook to Move from Workflow -> Platform

Figure out the most important piece of data to a given customer set (the order in restaurants, the clinical note in healthcare).

Own and automate the workflow that controls that data (the Point of Sale System in restaurants, AI scribes in healthcare)

With that new data, solve all the most immediate problems that were previously unsolvable.

Build a platform for others to build on to cement your status as the central force of the workflow.

Expand over time to own more and more of that platform.

2. Complexity is a Moat

Toast succeeded because restaurants are the worst customer set I can think of (again, all due respect). Complex, low margin, low annual spend.

And that difficulty is what made it hard to execute and limited the amount of competition that would go after it. Who wanted to build hardware, software, and take on the GTM challenge of selling and marketing to 100k(!) locations?

Well, the one who did became a $25B company.

At the same time, the constant turnover of restaurants creates a consistently new market of customers, perfect for upstarts.

I’m reminded of Steve Schwarzman’s (Co-founder of Blackstone) quote: “The harder the problem, the more limited the competition, and the greater the reward for whoever can solve it.”

3. The existence of Toast precludes the existence of the next Toast.

Toast’s playbook is brilliant, but it’s already been played out in restaurants. There can’t be another toast because Toast already exists. They also benefited from weak or non-existent incumbent System of Records. The weaker the competition, the bigger the opportunity.

4. The Current AI Opportunity

Dare I end on one more Charlie Munger quote (from Founders podcast, so loosely translated): “If you're actually paying attention, right, you can spot opportunities in parallel industries.”

A new age of workflows is now automatable with AI, many of which own the most important data to a given customer set (customer meetings in sales, clinical notes in healthcare, legal documents in law, and much of the “agent landscape”).

The path for those companies to expand into systems of records is clear: use the new data that was previously inaccessible, automate the most painful customer workflows with that newfound data, expand as a platform, and gradually build the system of record.

While it took time for Toast (5+ years to expand to a platform), and it will take time with AI companies, this is the clearest path I see to building the “next Toasts.”

That combination of Toast’s playbook + a complex problem in a niche industry + AI-automatable workflows creates a new opportunity to build billion-dollar vertical software companies. An opportunity Mark Leonard (and his littany of hyper-niche-vertical software companies) could get excited about!

As always, thanks for reading!

Disclaimer #2: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Thanks for this, I've been looking at TOST for a while! Nice to have the history in one piece!

Mannn your articles are always on point and I love seeing your graphics , in fact I’ve used your spacex graphic b4 in a presentation about vertical integrators - how do you generate those graphics?