Q4' 24 Hyperscaler Report: AI Supply & AI Demand

CapEx, Growth Rates, Market Share, and some thoughts on the ROI of AI

For new readers since my last quarterly update, I like to publish a quarterly update on hyperscaler performance and commentary.

The hyperscalers are in a unique position as the middleman between “AI Supply” (GPUs, data center, energy) and “AI Demand” (inference, applications, cloud GPU) rentals.

In many ways, hyperscaler CapEx is the most important number in the ecosystem. Certainly, on the “AI supply” side, hyperscaler CapEx is the most direct proxy for revenue, given hyperscalers make up ~50% of Nvidia’s data center revenue.

Combined, the hyperscalers (MSFT, AMZN, GOOGL, META) are expected to increase CapEx by 42% next year.

This quarter’s CapEx alone increased 68% Y/Y, sheesh!

Their CapEx plans don’t hint at slowing spending yet; this will be the largest absolute jump in CapEx spending (if estimates hold) ever.

Currently, the hyperscalers are all capacity constrained, but hinted to those supply constraints easing by the end of the year:

“We have been short power and space. And so, as you see those investments land that we've made over the past three years, we get closer to that balance by the end of this year.” - Amy Hood (MSFT CFO)

“We're still growing at a pretty reasonable clip, as I mentioned earlier, but I do think we could be growing faster if we were unconstrained. I predict those constraints really start to relax in the second half of '25.” - Andy Jassy (AMZN CEO)

This brings up an important point: we’ve been compute-constrained since ChatGPT launched. This means we haven’t seen the unhindered demand for AI applications. Once “AI Supply” catches up to “AI Demand,” we’ll see a real measure of the aggregate demand for AI solutions today. That will be an important moment for the ecosystem.

Now, hyperscaler CapEx is not a perfect proxy for AI demand. The hyperscalers are likely to overspend, as they should! Carrot of AI revenue + Stick of disruption/missing AI wave + hundreds of billions on their collective balance sheets = play the AI CapEx game. I called this out last year when discussing the “ROI on AI” debate:

The equation for hyperscalers is relatively simple: data centers are at least 15-year investments. They are betting compute demand will be higher in 15 years (not a crazy assumption).

If they do not secure these natural resources, three things could happen:

They will lose business to competitors who have capacity.

They’ll have to secure sub-optimal land with worse price/performance profiles.

Challengers will buy this land and power capacity and attempt to encroach on the hyperscalers.

If they secure this land and don’t need the computing power right away, then they’ll wait to build out the “kit” inside the data center until that demand is ready. They might’ve spent tens of billions of dollars a few years too early, and that’s not ideal. However, the three big cloud providers have a combined revenue run rate of $225B+.

As Google’s CEO Sundar said, “The risk of under-investing is higher than the risk of over-investing.”

Of course, this equation ultimately comes down to what problems AI can solve and the scale of those problems. We’ve seen the upfront capital expenditures; the question becomes, what time frame do those investments deliver returns?

We’ve seen strong early traction, especially from Microsoft (surpassed a $13B AI run rate this quarter). But these investments are made on a decade-plus time horizon; especially in these times, a long-term mindset is more important than ever.

A reminder from Nick Sleep on why, “We keep our discussions to as high a level as we can manage in the belief that, in the long run, the high level is all that matters.”

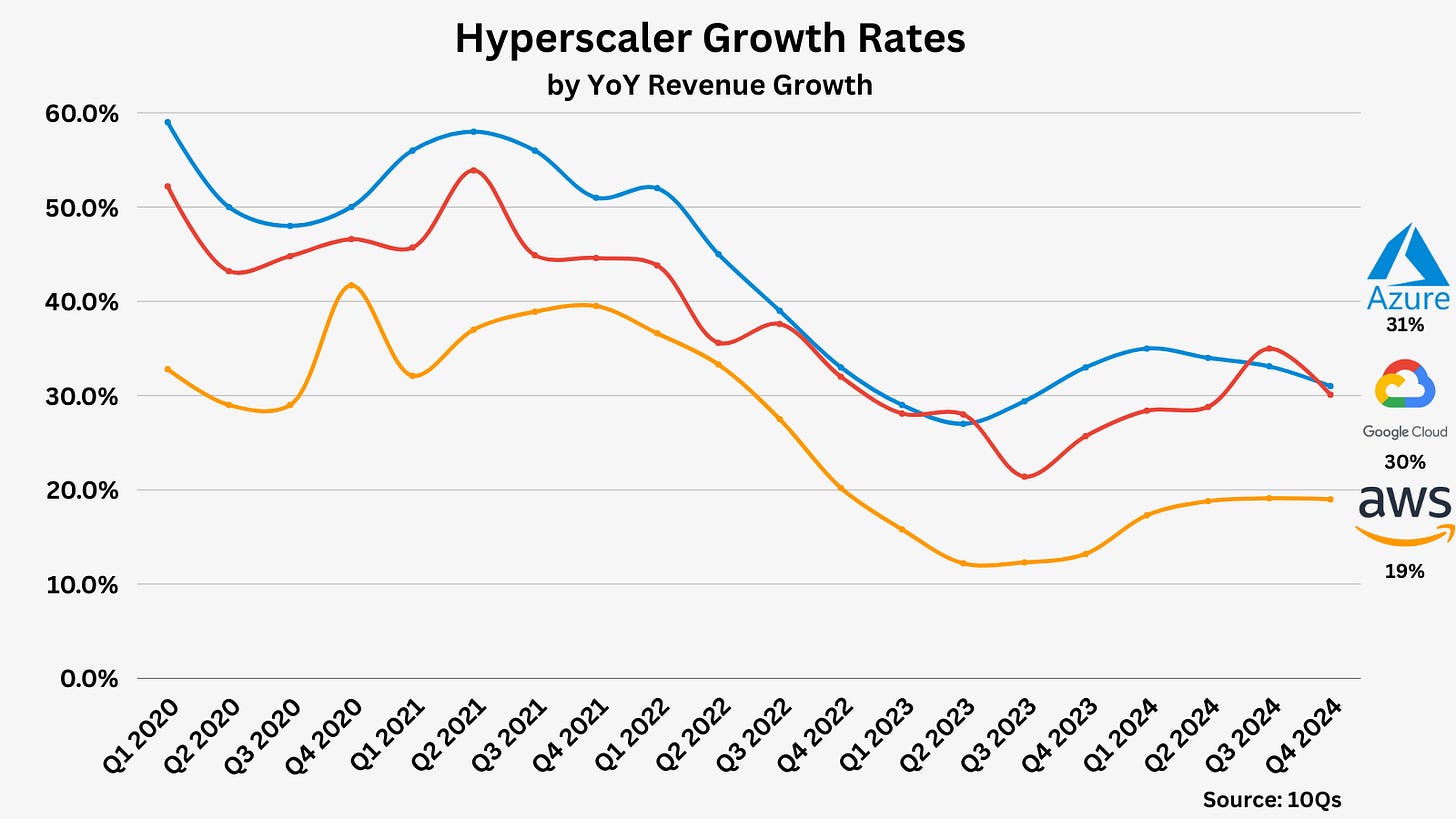

Market Share Updates

But alas, AI is still a fraction of revenue for the cloud providers. I know many readers like to see market share updates, so I won’t leave you wanting!

I wouldn’t read too much into each quarter’s fluctuations, but I’ll provide my estimates anyway:

The more interesting metric is tracking market share by net new revenue, which shows market share by the % of new revenue generated over the last year. This gives us the best idea of where market share is trending.

And finally, a reminder that these are some of the most impressive businesses to ever exist, surpassing a combined $237B annual run rate, growing 24.7% YoY.

Pretty incredible.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Just checking: did you disaggregate AMZN Capex between the retail and AWS businesses?

I am so curious if we added Stargate what that would look like.