SpaceX: The Story of Space Disruption

A deep dive on SpaceX's history, business and technology today, and the future outlook for the business

SpaceX might be the most singular company I’ve studied.

The inspiration for this article came from two sources:

News of SpaceX’s $350B valuation (And the big question: does this valuation make sense?)

A fascination with SpaceX’s culture after seeing many startups emerge from the ecosystem (like Radiant Nuclear).

SpaceX’s existence is proof of overcoming “impossible tasks,” and it’s inspiring a new generation of companies taking on “impossible tasks.” For me, these are the most exciting companies in the world (and feel free to send them my way if I should check them out!)

On the $350B valuation, investors can justify the valuation through three layers, with increasing amounts of belief required:

Layer 1: Starlink is a rapidly growing, market-expanding technology for satellite internet. As they scale, they can increasingly tap into the traditional internet market worth hundreds of billions in annual revenue. Combined with a dominant position in the space launch business, SpaceX has the growth, market opportunity, and moats to justify a $350B valuation.

Layer 2: The rapidly decreasing cost of space launches unlocks new use cases for satellites and space-based industries. SpaceX is the dominant company of the burgeoning space economy.

Layer 3: SpaceX does get to Mars and becomes THE company of the Mars economy. An investment in SpaceX is essentially a call option for multi-planetary travel.

Warren Buffett says he likes to invest in companies he’s confident will be around decades from now. It’s hard to see a world where SpaceX isn’t around decades from now.

The rest of the article will cover the history, technology, business model, market, financials, and outlook for SpaceX moving forward.

1. The History of SpaceX - The Story of Space Disruption

Before we dive in, we should set the stage for the story of SpaceX. They genuinely believe in their mission to make the species multi-planetary. They refuse to die in pursuit of that vision. They needed to disrupt a stagnant industry to do it.

Three words: mission, perseverance, disruption.

SpaceX started with the mission to reach Mars, not with a business model!

On mission, see this quote from Packy McCormick’s deep dive on Radiant:

“When Musk launched SpaceX back in 2002, he conceived it as an endeavor to get humanity to Mars,” Walter Isaacson wrote in Elon Musk, “Every week, amid all the technical meetings on engine and rocket design, he held one otherworldly meeting called ‘Mars Colonizer.’ There he imagined what a Mars colony would look like and how it should be governed.”

On perseverance, SpaceX’s early years were defined by facing failure after failure. After their 3rd failed launch and running out of money, he sent this note to the team (from Founders Podcast):

“Elon seemed to recognize the emotional toll that the failure might inflict on some of his engineers. Not long after the accident, he typed up an uplifting memo to the SpaceX team. As part of his note, Elon offered some comforting perspective. Other iconic rockets, he noted, had failed often during early test launches.

And so he starts listing ones in Europe and the Russians and the American program. And he said, "Having experienced firsthand how hard it is to reach orbit, I have a lot of respect for those that persevered to produce the vehicles that are mainstays of space launches today.

SpaceX is in this for the long haul, and come hell or high water, we’re going to make it work.”

Finally, Elon has the most intuitive understanding of disruption I’ve seen. SpaceX started with small, very efficient rockets. They completed the same task, with much less performance and MUCH cheaper than competitors. Then, they scaled up the industry, increasing performance with a new business model that the incumbents couldn’t keep up with.

Mission. Perseverance. Disruption.

The Early Years - The Falcon 1

[Much of this section comes from the Acquired podcast, the Founders’ podcasts on Elon, and Walter Isaacson’s biography on Elon.]

The SpaceX story starts post-PayPal, where Elon is a co-founder and ends up making ~$170M from their acquisition by eBay. He leaves Silicon Valley and goes to LA. There, he meets an organization called “The Mars Society” and gets hooked on this mission of bringing humanity to Mars.

After that, he starts figuring out how to make that happen. He famously meets with the Russians and tries to buy a rocket from them, but they can’t come to a deal. So, in classic Elon fashion, he decides they can build the rocket themselves.

They document the costs of the raw materials of a rocket and find they make up ONLY TWO PERCENT of the cost of a rocket. The other 98% goes to the cost and margins of the aerospace contractors and subcontractors.

Some basic context on the aero industry at this time: The industry operated on a cost-plus contract basis where a contractor like Boeing or Lockheed accepts a contract and charges a marginal % on top of their cost to produce. They then sub-contract for many parts and processes; in each of these layers, each company adds on a healthy margin. There was no incentive to cut costs! As Bezos says, your margin is my opportunity. And what an opportunity it was for SpaceX.

Early on, SpaceX made two key hires: Tom Mueller (who would become the lead rocket engine engineer) and Gwynne Shotwell (who would become COO).

SpaceX was founded in 2002, and they’d spend the next six years working towards a successful launch. They named their first rocket the Falcon 1, named after the Millenium Falcon. For reference, the size of the Falcon 1 (with one engine) is tiny compared to other rockets. This is classic disruption: start at the bottom end of the market and do it MUCH cheaper than competitors.

Their original goal was to launch in 2003. They don’t attempt their first launch until 2006. It fails. Their second launch in 2007 failed. Their 3rd launch in 2008 failed.

At this point, Elon’s running out of money; he’s just taken over as the CEO of Tesla, the Great Financial Crisis is starting, and SpaceX has one more shot. They raise $20M from Peter Thiel at Founders Fund (another co-founder of PayPal) for one more launch.

It works. They ended up successfully launching on September 28, 2008. They only do one more launch with the Falcon 1 to send a Malaysian Satellite into orbit. By now, they’d already moved on to their next design.

The Business ~Takes Off~ with The Falcon 9

SpaceX is still not out of trouble at this point; they haven’t generated large-scale revenue yet, and this is a capital-intensive business. Throughout this time, Gwynne Shotwell is leading business development. At the very end of 2008, she helps SpaceX win a NASA contract for $1.6B to send 12 cargo missions to the International Space Station.

This contract changed SpaceX's trajectory; it went from a very uncertain financial future to a clear and significant source of revenue for the coming years.

To deliver on these missions, they needed a bigger rocket: The Falcon 9.

The naming convention was simple: the Falcon 1 has one engine. The Falcon 9 has nine engines on a much larger rocket:

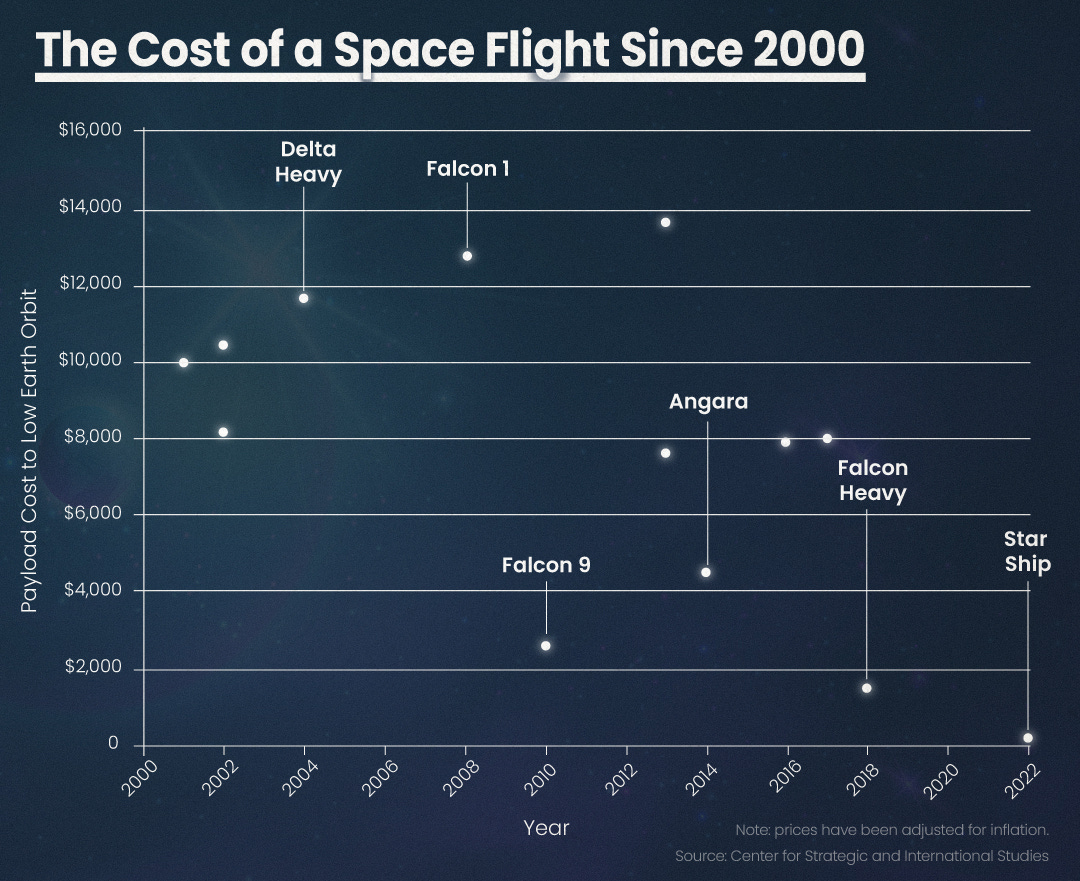

Its first launch was in 2010, and its first commercial resupply mission for the aforementioned contract is on December 12th. The Falcon 9 is a massive step forward in the cost/kg equation for space launches:

NASA ran an internal audit to estimate the cost of developing the Falcon 9 using a traditional cost-plus contract. They estimated between $1.7B-$4B of development costs. SpaceX’s cost? $300M.

Approximately 10% of the cost. (Disruption disruption disruption).

A large contributor to the increasing cost equation came in 2015 when SpaceX landed the Falcon 9 for the first time. Now, the launch cost equation drops significantly because rocket development costs can be amortized over several launches.

In that same year, they’re valued at $12B.

From 2015 to 2020, SpaceX continues to execute, grow its business, and grow its fan following.

I was in my freshman engineering class at Purdue in 2018 for a SpaceX launch. Hundreds of kids watched the launch, and they spent the rest of the class (2 hours) talking about it. SpaceX is a great company, but its impact is much more than that.

SpaceX made engineering cool again. Instead of just dreaming about being a software billionaire, young engineers wanted to build cool stuff again. Rockets are the peak of “cool stuff.”

Some fast-forwarding with important milestones in that time:

2015: Starlink announced

2016: First droneship landing (sea vessel that moves by itself to “catch” the rocket). SpaceX signs a $2.6B NASA contract to send astronauts to the ISS.

2017: First rocket reused for a flight.

2018: The Falcon Heavy is launched, taking a Tesla Roadster into space. The next iteration of the Falcon 9, the Falcon 9 Block 5 is launched.

2019: The Dragon spacecraft autonomously docks with the ISS, the first ever. In 2020, SpaceX sent astronauts to the ISS, the first commercial company to do so.

Starlink Launches

Also, in 2019, SpaceX began its first operational Starlink launches. Before Starlink, SpaceX was launching satellites for other companies and for the government. Starlink was a further step in vertical integration, moving up to the “application layer.”

Starlink offers satellite internet to rural and mobile customers and is rolling out cellular service through T-Mobile. The basic idea is that Satellite service can provide much broader coverage but to a less dense collection of customers. Starlink’s vision is to create a worldwide “mesh” of satellite coverage that provides internet to anyone in the world.

In just 5 years since its first operational satellite, Starlink has grown to nearly $7B in annual revenue, with approximately 7000 satellites in orbit. SpaceX has said they want to expand that number to thirty or forty thousand.

The Starship

Starlink continues to generate huge amounts of revenue, and much of that is going to fund the Starship.

The vision for Starship is to be a super-heavy, fully reusable rocket that can take people and cargo to Mars. It was originally announced in 2012, had its first successful test launch in 2023, and as of December 2024, is gearing up for its 7th test launch.

It will be over 4x the weight of the Falcon 9 Heavy and 2-4x the payload weight:

This brings us to the current state of the business: a dominant launch business, a rapidly growing satellite internet business, and the constant mission to get humanity to Mars.

2. A Primer on SpaceX Technology

At this point, we should take a step back and walk through what SpaceX is actually building. My goal is to keep this section as short and simple as possible; it is rocket science after all.

The Components of a Rocket

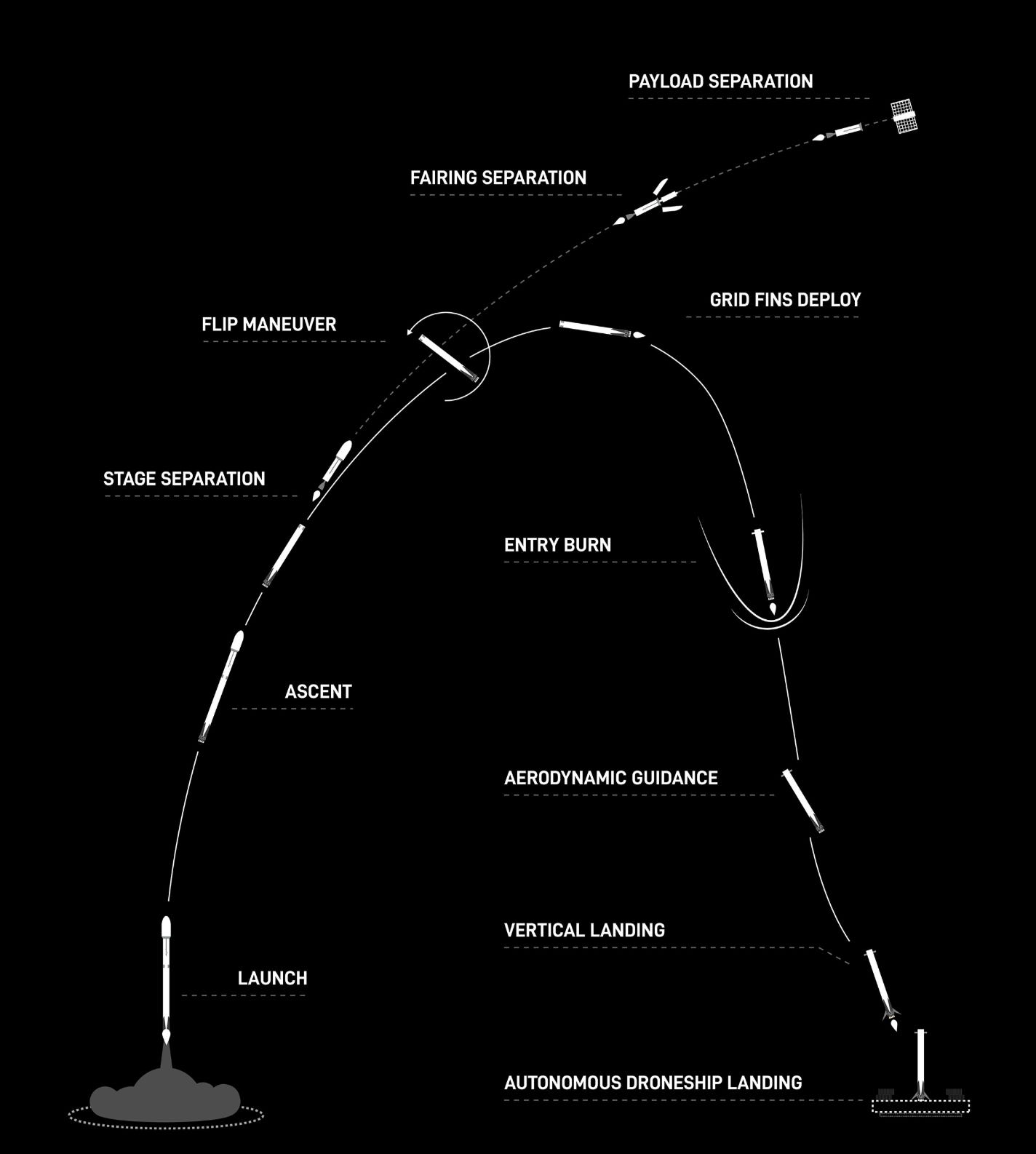

First stage - Large, powerful section of the rocket that provides the initial thrust to break Earth’s gravity. The Falcon 9 has 9 Merlin engines to deliver the thrust. It’s designed to be reused multiple times. The starship will use the raptor engine:

Second stage: Component that carries the payload the rest of the way to orbit, powered by one engine.

Payload: The cargo, whether that be humans, satellites, or goods, that the rocket carries into space.

When the rocket launches, the first stage, and its engines are ignited to provide the initial thrust to the rocket. Shortly after, it separates with the interstage (holds the first and second stage together), and the one engine on the second stage takes the payload into orbit. Once in orbit, the payload will be delivered, and the second stage will fall off.

SpaceX’s Rocket Lineup

SpaceX’s current lineup includes The Falcon 9 Block 5, The Falcon Heavy, and soon to be the Starship:

From our friends at Contrary,

The Block 5 is considered the most reliable launch vehicle in history, boasting 303 successful launches and just one failed launch as of August 2024 (a 99.7% success rate) since its debut in May 2018. This includes one launch with astronauts onboard in May 2020 – becoming the first crewed orbital spaceflight launched from the United States since 2011.

https://research.contrary.com/company/spacex

The Falcon Heavy consists of 3 Falcon 9 engine cores powered by 27 Merlin engines.

Finally, the Dragon is the vessel that delivers humans (Crew Dragon) and cargo (Cargo Dragon) to the space station.

As of August 2024, the Dragon has had 42 visits to the International Space Station.

Starlink and How it Works

Over the last 5 years, SpaceX has launched nearly 7k Starlink satellites with the goal of creating a mesh network worldwide.

To connect to the network, users then get a dish installed at their site that communicates with these satellites. You then send requests to the dish via Wi-Fi, and the dish sends it to the nearest Satellite, which sends the request to strategically placed ground networks that connect to the internet to retrieve the information. That information then travels in reverse order back to you.

3. The SpaceX Business Model

SpaceX’s business model is simple: build rockets, charge governments and companies to launch stuff into space and launch their own stuff into space. Vertically integrate everything.

SpaceX is the vertically integrated space company.

Revenue & Unit Economics

Diving into the numbers of Starlink: SpaceX passed 4M subscribers in September of 2024, up from 3M in May of 2024! That would generate approximately $5.8B in recurring revenue. With a $600 setup fee on the estimated 2M new subscribers this year, that adds another $1.2B and gets us to $7B in revenue.

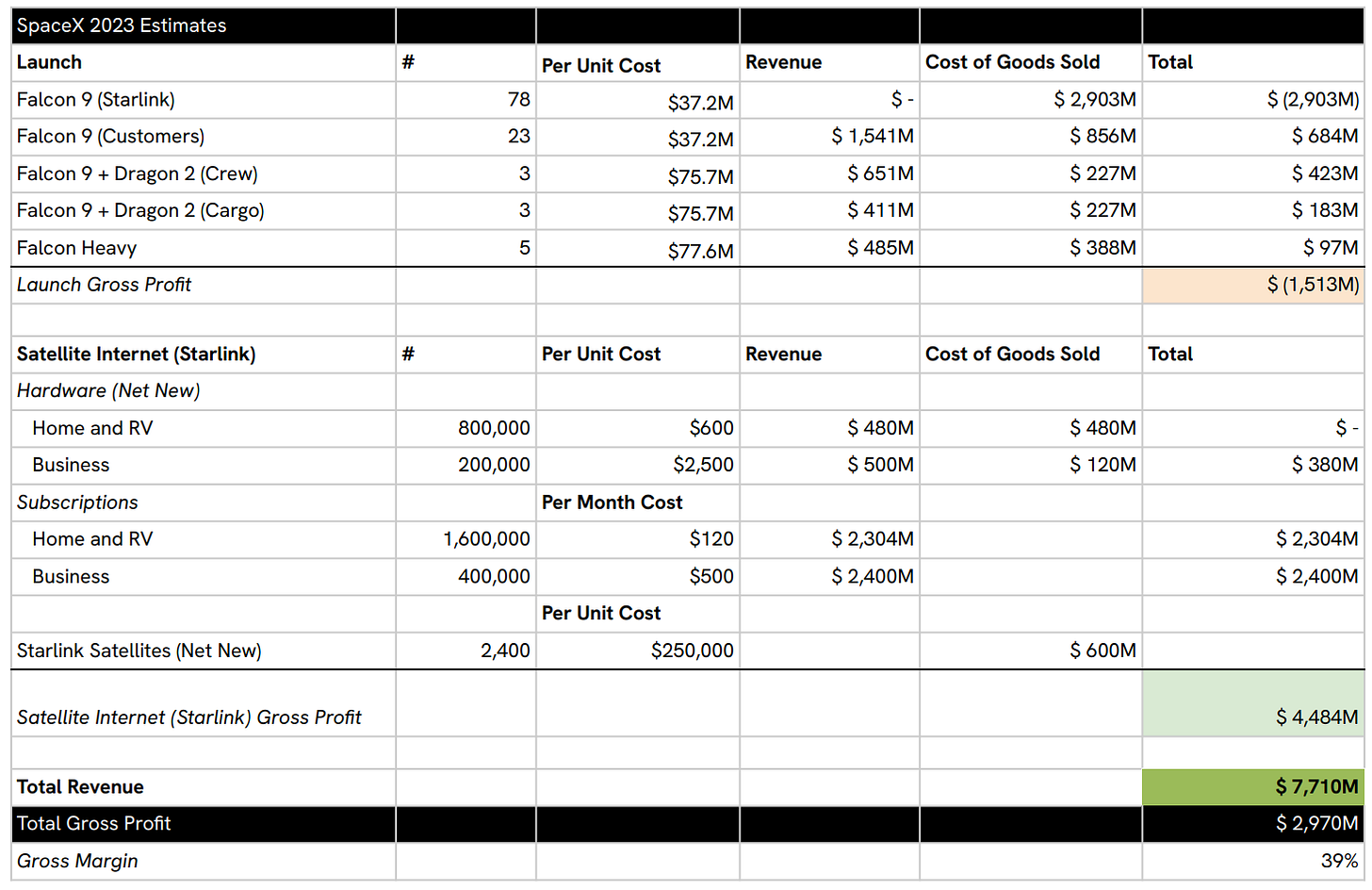

Mach 33 has also done some excellent work covering SpaceX’s margin profile. In 2023, they estimated the launch business was profitable for each launch (excluding Starlink). Starlink contributed $4.48B in revenue in 2023. Combined, that left SpaceX with a gross margin of 39%:

If SpaceX roughly maintained that gross margin in 2024, they were left with $5.2B in gross profit in 2024. Now, the accounting of capital-intensive businesses can be tricky, and SpaceX has been private with their financials, so this shouldn’t be taken as fact.

Elon has previously said SpaceX might spend $30B over a decade to build out Starlink. If we amortize that at $3B a year for launches and Starlink is already doing $7B in annual revenue at an 80-90% gross margin, then Starlink is set to become a VERY profitable operation.

After the majority of launches are done or the Starship drops launch costs by orders of magnitudes, then the economics look even better. Put simply, Starlink looks likely to generate billions in profits in several years and help fund SpaceX’s big ambitions.

The Decreasing Cost of Launches

The interesting economic variable here is the decreasing cost of launches:

In the Business Breakdown Episode on SpaceX, it was shared that the cost of launches could drop from ~$2000/kg to $10/kg!

And Musk has suggested that a variable cost of around $10 million per launch is the ballpark figure that they'd be aiming for at scale in a steady state, ambitiously maybe even falling to $2 million—a figure which has been touted. If you believe those kinds of performance levels are feasible, that gets the cost down to around $10 per kilogram.

Even if that’s off by a magnitude of 10, that’s still a 10-20x price decrease on the current best total cost offering on the market!

This leads to the interesting question of what use cases are unlocked by this drop in launch prices. (More on this in the final section).

Competition

SpaceX does have competition, so I don’t want to discredit them. Relativity Space, United Launch Alliance, Blue Origin, Boeing, Rocket Lab, and China/Russia compete for launches.

In satellites, they have many competitors, including Amazon’s Kuiper program. Many startups, like Astranis, are taking on this market with varying approaches.

A dated image shows SpaceX dominating the market back in 2018:

SpaceX’s revenue in 2018 was estimated to be $2B, which is up to an estimated $5.5B in 2024, so we can reasonably assume that market share has expanded since.

Perhaps a deep dive into industry competitors is due in the future.

The SpaceX Effect - The X Factor

The final variable, that was the genesis for this article, is the quality of people that SpaceX attracts. It has the most ambitious mission in the world, and that draws in incredible people.

Here’s a great piece documenting this phenomenon.

I continue to meet incredible founders and innovators coming out of this ecosystem, and occasionally, there are vortexes of talent that go on to create incredible things in the world. You can see just some of the companies founded here out of the SpaceX ecosystem:

SpaceX has been a world-altering company, and it’s planting the seeds for more world-altering companies to come.

4. SpaceX’s Future: Does $350B make sense?

Of all the companies I’ve written about, and perhaps any I’ll write about moving forward, SpaceX has the most interesting potential future. If its vision is achieved, this company changes the trajectory of our species.

If the decreasing cost of launches continues to unlock new use cases in space, then this creates another multi-trillion-dollar company. If it doesn’t happen, SpaceX is still one of the US’ most important strategic assets.

As I look forward, there are three layers of belief to justify SpaceX’s valuation:

1. The Starlink Business + Launch Dominance + A Healthy Multiple

Starlink’s grown revenue from $1.4B in 2022 to approximately $7B in 2024, to a projected $11.8B in 2025.

The satellite internet market already generates ~$12.7B in annual revenue, and 33% of the world doesn’t have access to Wi-Fi. Starlink is a classic market-expanding technology. Something akin to Uber’s market expansion for taxis outside of cities. (If you read my annual letter, you know this is not just an issue for impoverished countries. Much of the rural US can’t get reliable internet.)

Starlink also makes sense for planes and other mobile internet needs (dare I say planes, trains, and automobiles?).

Additionally, T-Mobile signed a deal with SpaceX to expand cell phone service to non-covered areas. It’s not hard to see SpaceX signing many deals like this.

Finally, if you believe in the theory of disruption, SpaceX is starting with non-consumers! As technology and coverage improve, they can encroach more and more on the traditional Internet business (closer to a $1T annual revenue opportunity, according to Elon).

If we assume a 10-15x P/S multiple, Starlink is worth $70B-$115B today or $120B-$180B with next year’s expected revenue.

We can add in the $5.5B launch business with a similar multiple and add $55B in market cap, and we can see a bull case for a $230B valuation without much imagination or an Elon multiple booster!

2. A SpaceX investment is a bet on the burgeoning Space Economy

The second layer of belief is that the rapidly decreasing cost of launches unlocks new use cases in space.

The basic idea is that space provides a sterile environment that removes many of the challenges and risks in fields like biological research or semiconductor manufacturing.

Another example is solar-powered data centers in space. You say this is crazy? Sundar and Elon are open-minded!

If anyone’s building companies taking advantage of the decreasing cost of launches, do let me know. I’d love to learn from you.

3. A Call Option on the Mars Economy

Finally, what if SpaceX does get to Mars? I have no answers on what this looks like or how to value it, but an investment in SpaceX adds some value, like a call option on the Mars economy.

If the Mars economy or multi-planetary travel does develop (even 50 years from now!), SpaceX will likely capture hundreds of billions of dollars of value.

If anyone has an idea on how to financially model this, feel free to let me know!

Summarized, I think the majority of the $350B valuation comes from the business today (maybe ⅔ of it), and the last ⅓ is something like a call option on the future space economy.

For anyone out there still reading (thank you for powering through!), I’ll add a final note of admiration.

SpaceX took an industry that had fallen from being the pride of the country and, through grit and perseverance, made it the pride of the country again.

SpaceX has planted seeds for founders. But they’re also planting seeds for the rest of us. It’s inspired kids to become engineers again, to take on “impossible tasks.”

My hope is that we see more and more people take on “impossible tasks.”

We’re seeing a new age of industrial giants (SpaceX, Tesla, Anduril, etc). SpaceX started that wave. As software becomes easier to develop, value flows to the underlying hardware (commoditize your complement). This opens the door for vertically integrated technology companies to reinvent industries and create new ones.

I, for one, am here for it.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Hi Eric,

Thank you for an informative article and good start for some due diligence. Of note, I noticed that the link you have to compare the development cost for the Falcon 9 v cost plus scenario only obliquely mentioned it. This link has a slide that explicitly noted your numbers: https://www.nasa.gov/wp-content/uploads/2015/01/586023main_8-3-11_NAFCOM.pdf#:~:text=Results:%20%E2%80%9CThe%20activity%20estimated%20Falcon%209%20would,adjusted%20to%20a%20more%20commercial%20development%20approach.

Next writeup on the nascent space economy/ecosystem? Seems under covered and there are alot of interesting companies (in addition to SpaceX) such as Blue Origin, RDW, RKLB, LUNR etc.