The Evolution of Digital Advertising

The History of Digital Ads, Aligning Incentives, and Business Models That Really Work

If businesses are goods and services to provide value to customers, then business models are the frameworks to deliver that value. A small category of business models ~really~ work. Shared economies scaled, marketplaces, internet aggregators, technology platforms, etc that have the potential of building $100B+ companies.

As I’ve been thinking about those business models for AI companies, I’m afraid I sorely overlooked the most powerful economic force that drove the last wave of consumer giants: advertising.

Nearly every large consumer technology company founded over the last two decades was built on the business model of marketplaces, advertising, or both.

The business models that ~really work~ ultimately come down to aligning incentives.

On the internet, advertising was the only way to align incentives for all parties involved. Consumers wanted free products. Creators wanted to get paid for their services. The aggregators wanted to make money. Advertisers wanted to sell to consumers. Advertising via aggregated networks aligned incentives for everyone.

For the most obvious example, Google and Meta capitalized on aggregating and auctioning off attention. They did so with a dominant consumer product, user data, and training models on that data. In doing so, they created arguably the best business models of all time.

For a less obvious example, AppLovin helped incentivize the mobile gaming ecosystem by creating an advertising network for mobile gaming. It provided a means for creators to profit from their games. In a world of thousands of mobile apps, advertising created economic incentives for creators to build better apps and profit from them.

Let me play those two examples back:

Dominant consumer products, user data, and training models on that data.

In a world of thousands of mobile apps, advertising creates economic incentives for creators to build better apps and profit from that.

The parallels we’re seeing in LLMs and AI app development platforms are remarkably parallel to those two developments in recent waves of technology.

This brings us to a very clear question: Can advertising be the answer to align incentives for all parties in the AI ecosystem?

This will be the first in a three-part series covering advertising business models in the age of AI.

This article will explore the evolution of digital ads and lessons from the last generation of advertising giants.

Let’s get to it.

The Evolution of Digital Advertising

As we look back at the history of digital advertising, we see a few very clear trends:

Google captured and monetized interest, by targeting ads when a user came to them.

Facebook captured and monetized attention, by targeting ads based on users’ interests.

AI supercharged both models, by taking user data and improving targeted advertising.

Tiktok catalyzed the shift from social media to media, by supplying content based on interest instead of relationships.

Amazon captured and monetized intent, by targeting ads when a user came to buy.

Data privacy measures were implemented, forcing ad networks and advertisers to rethink how to advertise.

Throughout all of this, there were a few key lessons:

If you can capture attention, you can monetize through advertising.

The more you can influence consumer behavior, the more you can charge per ad.

The more engaging and personalized ads can be, the more you can charge per ad.

The final lesson is that while advertising is an incredible business model, basically everyone has some level of discomfort with it. Google resisted ads, Facebook resisted ads, Amazon resisted ads, (more recently) Perplexity resisted ads. But it’s just an incredibly powerful way to provide services for “free” on the internet, create incentives for creators, provide value to advertisers, and create value for the ad networks.

This article calls out several digital advertising articles on Stratechery; I highly recommend the decade-plus of articles he has on these companies.

The Early History of Digital Advertising

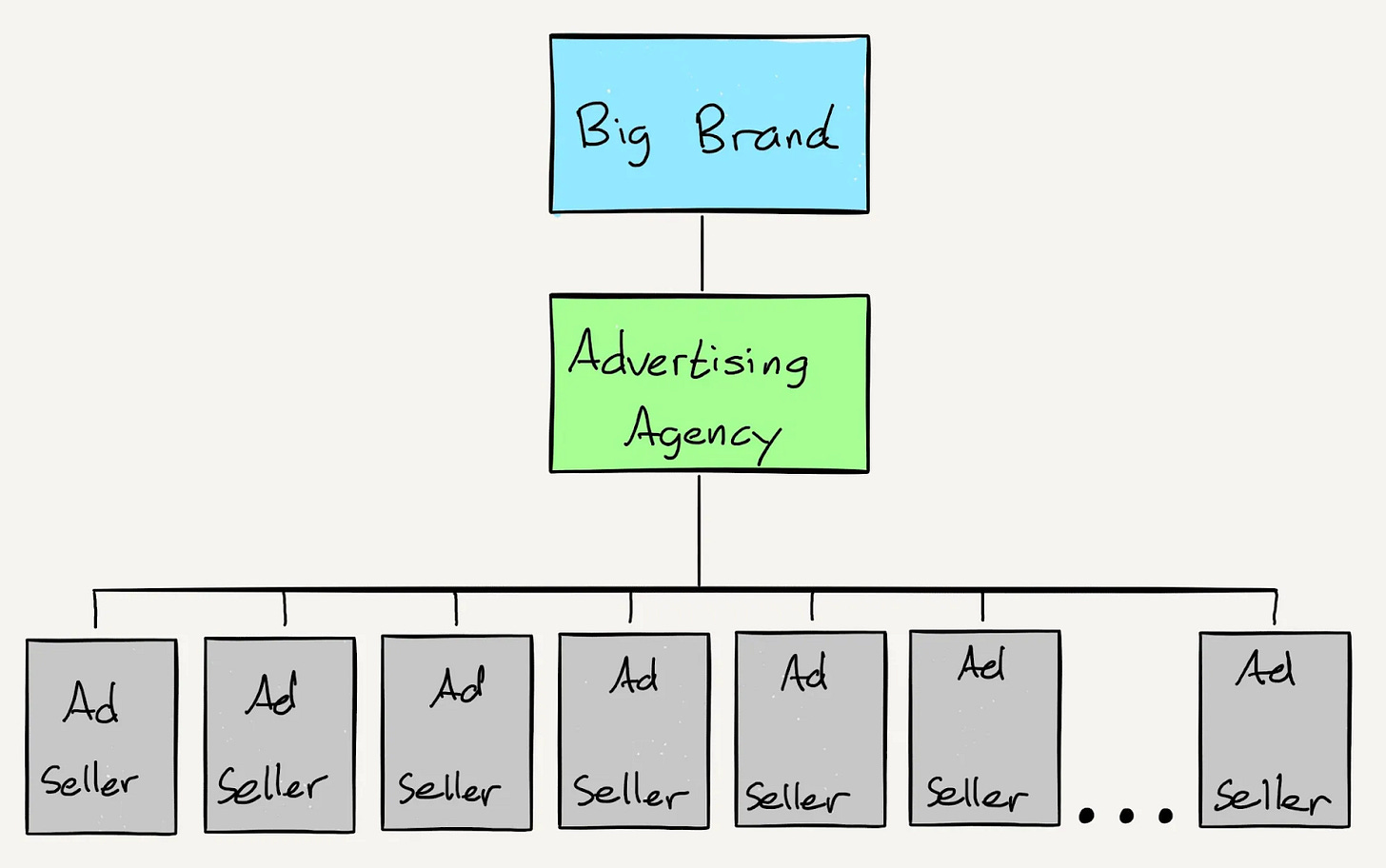

For the better part of 100 years, advertising meant newspapers. They had monopolies on distribution and monopolies on attention via that distribution. A big brand would partner with an ad agency, who would maintain relationships with many publishers, negotiate bulk rates, and place those ads. Over time, they developed ads for clients as well.

Newspapers had a few problems: they had little “air time” by only running once a day. And they weren’t very immersive. Radio and television ads changed both of those:

Radio could run 24/7, which meant ads had much more air time.

TV had much more immersive advertising, with video and images.

All three had major limitations, including the number of ads to be shown, ad engagement, and tracking the success of those ads.

The First Wave of Digital Advertising

On all of those metrics, digital advertising was incredible for the industry. Advertisers could now directly target interested customers, track the success of their ads, and create a positive feedback cycle of data, improving ads, driving more sales, and gathering better data.

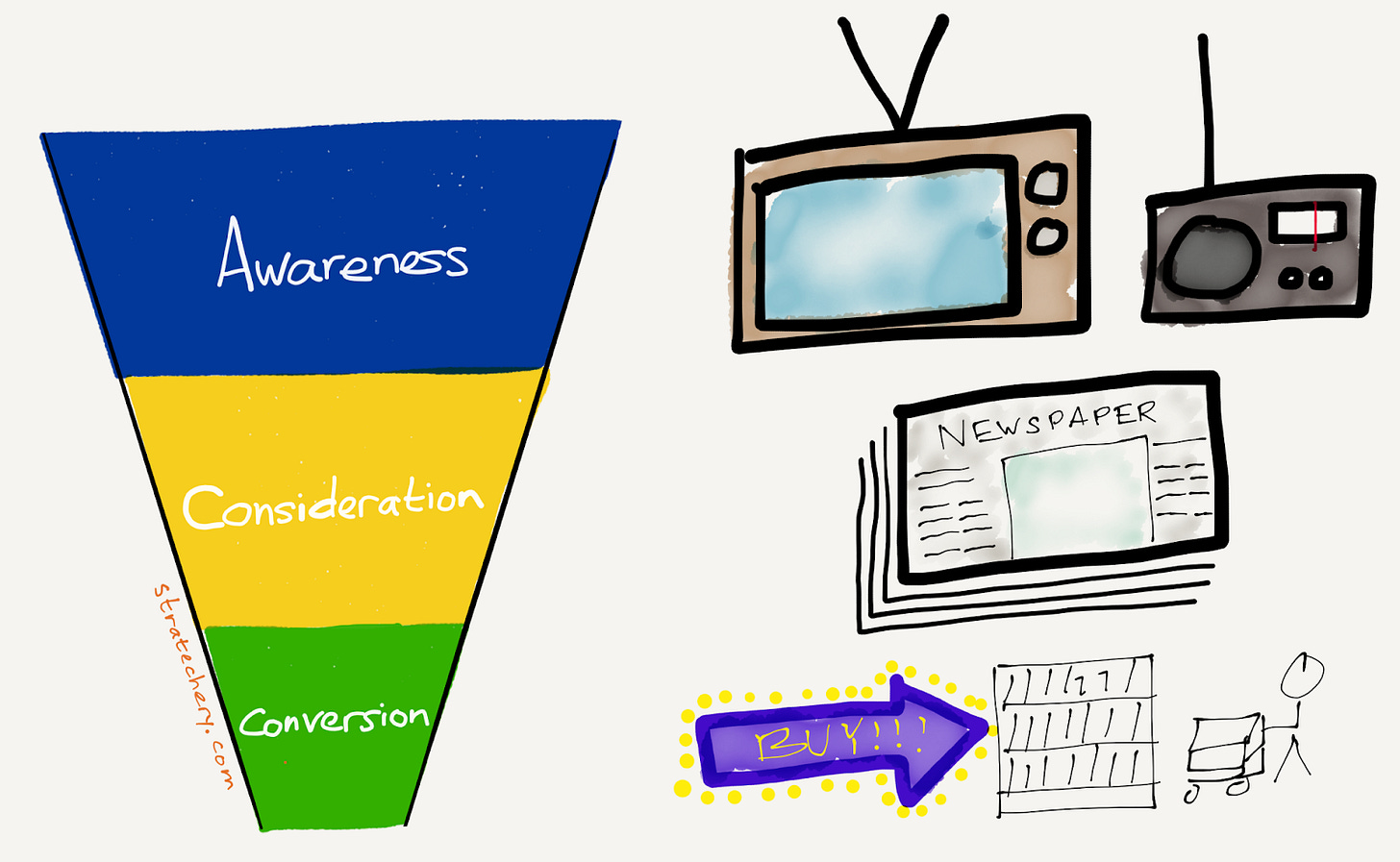

Google, founded in 1998, would go on to capture the VAST majority of value created by search. In Ben’s framework below, Google was the perfect model for “conversion.”

A buyer came to them, looking for information, and Google auctioned off the ability for companies to “provide” that information.

By monopolizing search, aggregating intent, and auctioning that intent off to the highest bidder, Google created one of the best business models of all time. But while Google captured intent, internet ads weren’t particularly good at capturing attention.

The Second Wave of Digital Advertising

Facebook changed that, starting with its founding in 2004. Facebook created this new paradigm of the “attention economy.” Users didn’t come to Facebook with intent; it was Facebook’s job to plant seeds of intent via advertising.

Again, they auctioned off that attention and created one of the best business models of all time in doing so.

That said, Zuck did not like ads for a long time and wanted Facebook to be a platform company. In Facebook’s early years, they essentially outsourced advertising to Microsoft.

Despite the distaste for ads, in hindsight, it’s clear just how powerful Facebook’s ads were. Five years after founding, they passed $1B in revenue, more than doubling Y/Y.

Then the smartphone flipped all previous notions of advertising on its head; Facebook had to rearchitect its platform. Now, with technology completely immersed in our lives, it garnered even more attention. With that attention, Facebook’s ad business got even better.

However, there was a huge lag time between the introduction of the iPhone and the adoption of mobile advertising. Facebook wouldn’t fully commit to mobile for years, at which point they had to go convince advertisers of the value of mobile ads. The attention had shifted, but the monetization hadn’t.

At this point, we knew a few things:

The more data you have on consumers, the more targeted the advertising can be.

The more ads you have on your platform, the more targeted it can be.

The more attention you can capture, the more ads you can sell.

Both Google and Meta had been capturing huge amounts of consumer data, but hadn’t maximally profited from leveraging that data.

The Introduction of AI to Advertising

Right around the same time Facebook started pushing mobile ads, the AlexNet project was released, kicking off the modern era of deep learning.

Google and Meta essentially created a duopoly on top AI researchers in 2013, 2014, and 2015. They offered (1) pay, (2) flexibility for AI research, (3) open-source support, and (4) the resources you want to do your research.

They realized that they could profitably spend billions on AI researchers and hardware, because the returns on targeted advertising were massive.

The equation of data + GPUs + attention + AI researchers became one of the most profitable equations in the world.

Just the year before, though, another monumental shift in advertising was kicked off with the founding of Musical.ly (which would go on to be acquired by ByteDance and become TikTok).

This marked the turning point for the social media industry. From this point on, the industry would trend towards becoming just media, and not social media. It matched users with content they interacted with, and became essentially an AI company.

Somewhat incredibly, ByteDance revenue nearly passed that of Meta’s last year.

Amazon Enters the Fray

In terms of both AI and advertising, Google and Meta were creating near duopolies. The network flywheels, the talent, and the innovation seemed impossible.

Amazon entered the advertising business in 2012, and it really took off later in the 2010s.

It took off for a few reasons

First and foremost, it could influence buying decisions more than any other platform in the world. It was the closest to the buyer, and the closest to the bottom of the funnel. People go to Amazon to buy.

Secondly, it had a unique dataset and distribution network. Amazon’s e-commerce market share is 40%+ in the US. They’re not the only game in town, but they’re definitely the biggest game in town.

Put simply, Amazon provided advertisers the most direct way to influence the buying decisions of the most number of consumers.

And boy, has it worked. Amazon did $17.2B in advertising revenue last quarter, and that’s likely at a VERY profitable margin. Analysts estimate EBIT margin is greater than 50% for Amazon ads.

The last variable that made Amazon such an ad juggernaut was that it mostly avoided the incoming data privacy regulations.

Apple App Tracking Transparency & Cookie Deprecation

In July 2021, Apple released their App Tracking Transparency policy, essentially restricting iOS user data from being tracked by apps like Facebook. Pre-ATT, data flowed freely; post-ATT, data did not flow freely.

Shortly after, Google would announce the planned deprecation of cookies as well.

So this had a few effects.

First, it opened up ~some~ competition as the data moats weren’t quite as the aggregators’ data moats weren’t quite as strong anymore. So companies like Uber, Instacart, and DoorDash were more incentivized to offer advertising.

Second, it forced apps like Meta to start leveraging probabilistic models instead of deterministic models, a fun precursor to AI’s models today.

Third, though, Meta still needed to increase ad revenue (more ads or better ads). Which conveniently leads us to the right framework for thinking about digital advertising.

A Framework for Thinking about Digital Advertising

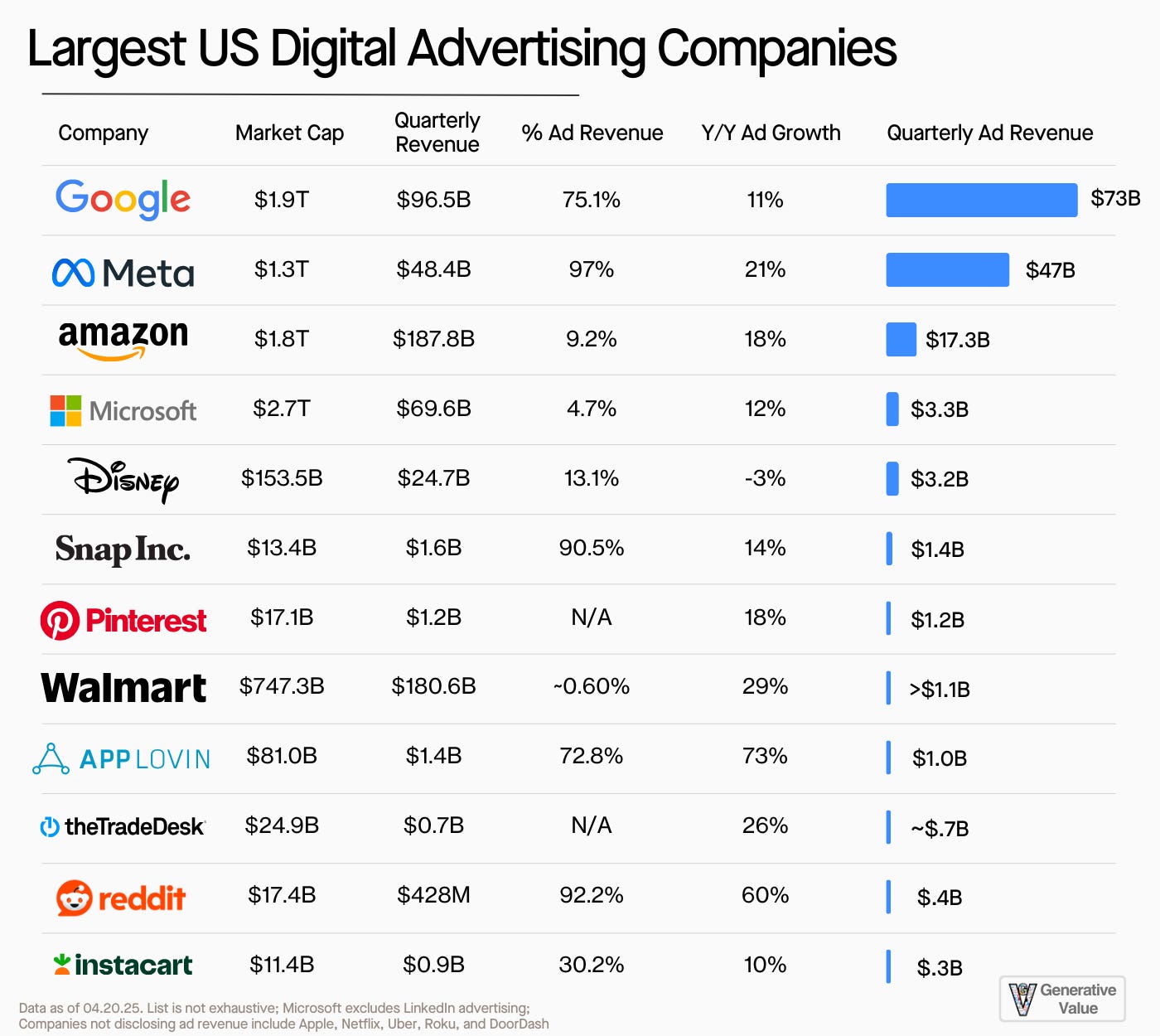

This brings us mostly to the current state of digital ads, dominated by three players: Google, Meta, and Amazon. With Tiktok as an emerging fourth player.

We’ve got an increasing trend of consumer aggregators (Uber, Instacart, DoorDash) leveraging ads for essentially free margin.

Finally, to be discussed more in the next article, we have infrastructure providers (like The Trade Desk and AppLovin) who match advertisers with ad slots across all platforms.

Now, summarizing everything, we have a fairly simple mental model for digital advertising.

The more attention you capture, the more ads you can place.

You can either increase attention by increasing the number of users (more apps or more users) or increasing engagement of the ads (Tiktok and Reels).

The more you can influence buying decisions, the more you can profit (Amazon > Google > Meta).

The better data you have, and the better AI you have, the better you can influence buying decisions.

We’re seeing the history of digital ads play out again: attention is shifting, wide-scale monetization has yet to follow, but a new generation of consumer giants is being built in front of our eyes. These companies have plenty of attention, incredible amounts of user data, and…pretty good AI.

Lest we forget Charlie’s wisdom, “Show me the incentive and I will show you the outcome."

The next couple of articles in this series will explore the combination of this mental model for advertising, applied to today’s AI companies, and see if the incentives can indeed show us the outcome for advertising in the age of AI.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

The Google and Facebook antitrust trials are fairly serious for the future of advertising.

BigTech always appeal antitrust regulation verdicts, delaying the process for years.

Brilliant write up Eric 👏 My Readers will love this ⭐